Utilizing the InvestingPro Inventory Screener, I recognized two shares which have the potential to ship spectacular returns within the yr forward.

Whereas these corporations function in distinct areas of the monetary panorama, each are positioned to learn from robust tailwinds.

Searching for extra actionable commerce concepts? Subscribe right here for 50% off InvestingPro!

As 2025 unfolds, the monetary sector provides promising alternatives for traders in search of development and stability. As per the InvestingPro inventory screener, two standout names poised for vital positive factors are Sq.-parent Block Inc (NYSE:) and M&T Financial institution Corp (NYSE:).

Supply: InvestingPro

Whereas these corporations function in distinct areas of the monetary panorama, each are positioned to learn from robust tailwinds that might drive their inventory costs larger within the coming yr.

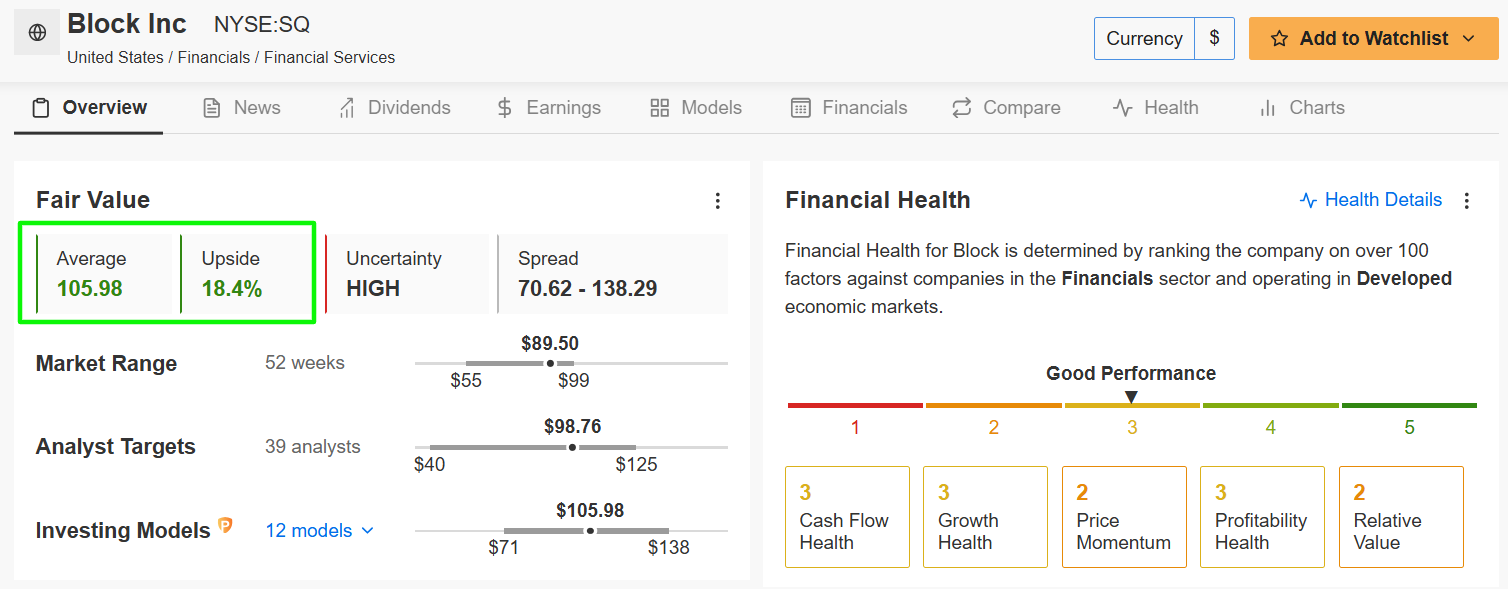

1. Block

Present Value: $89.50

Truthful Worth Estimate: $105.98 (+18.4% Upside)

Market Cap: $55.4 Billion

Previously generally known as Sq., Block is a monetary know-how chief that continues to revolutionize the funds trade. Recognized for its modern point-of-sale methods, the Jack Dorsey-led fintech firm empowers small and medium-sized companies (SMBs) with cutting-edge cost, analytics, and monetary instruments.

Past its core SMB options, Block’s widespread Money App has develop into a favourite for peer-to-peer funds and digital banking, providing companies like investing, financial savings, and direct deposits.

Supply: InvestingPro

With its modern enterprise mannequin and management in fintech, Sq. stays a high decide for growth-focused traders in 2025. Moreover, the corporate’s ventures into cryptocurrency and decentralized finance (DeFi) place it as a key participant within the evolving fintech panorama.

Primarily based on InvestingPro’s AI-powered fashions, Block’s honest worth is calculated at $105.98, whereas the inventory is at the moment buying and selling at $89.50. This means a possible upside of 18.4% from present ranges.

The corporate’s Monetary Well being Rating stands at 2.7 out of 5, suggesting average monetary stability. This rating displays varied elements together with the corporate’s liquidity place, debt ranges, and operational effectivity.

Supply: Investing.com

At present valuations, Block, which just lately modified its inventory ticker image from SQ to XYZ, has a market cap of roughly $55 billion. Shares have gained 34.2% over the past 12 months.

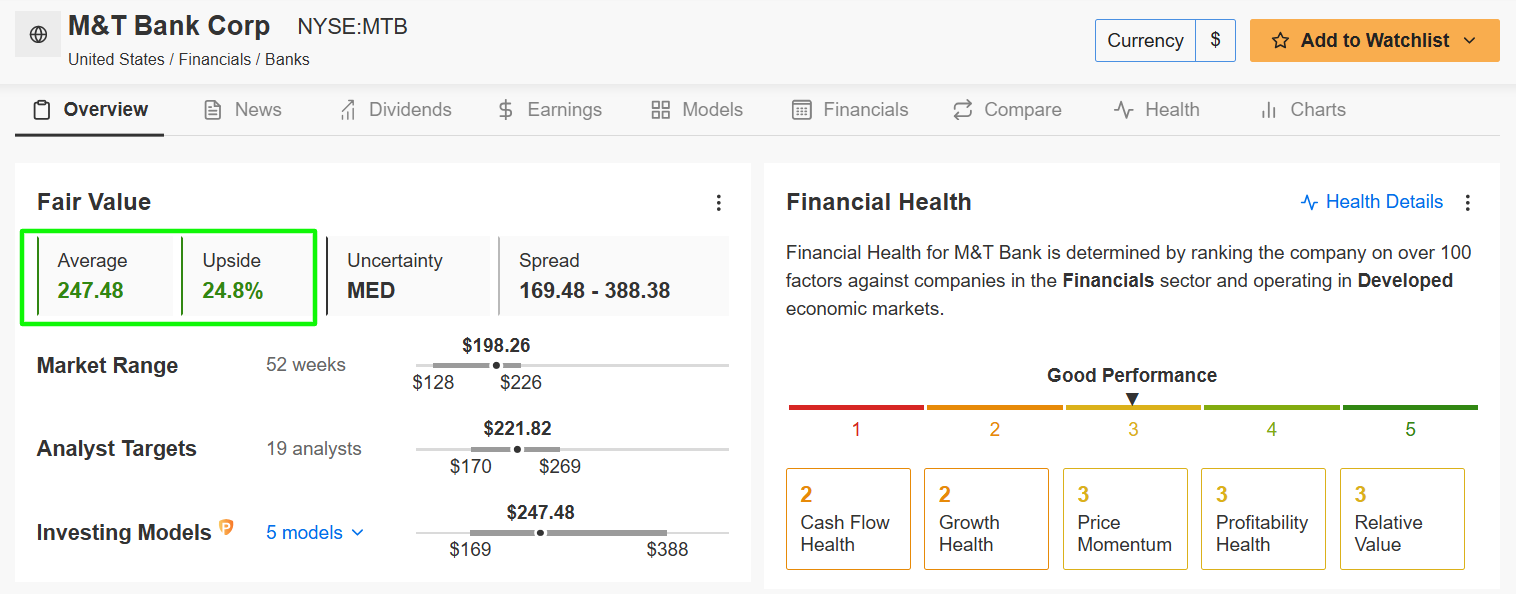

2. M&T Financial institution

Present Value: $198.26

Truthful Worth Value Goal: $247.48 (+24.8% Upside)

Market Cap: $32.8 Billion

M&T Financial institution Company, however, provides a extra conventional but equally compelling funding alternative. As a regional banking powerhouse serving prospects primarily within the Northeastern United States, M&T Financial institution offers industrial banking, retail banking, wealth administration, and mortgage companies.

Its status for conservative lending practices and relationship-focused banking has cemented its standing as a secure and dependable performer within the monetary sector.

Supply: InvestingPro

M&T is about to learn from a spread of favorable elements in 2025. Elevated rates of interest are anticipated to broaden internet curiosity margins, boosting profitability. Moreover, the financial institution’s ongoing digital transformation and cost-cutting initiatives are prone to improve operational effectivity, additional bettering its backside line.

M&T Financial institution’s honest worth is calculated at $247.48, in comparison with its present buying and selling worth of $198.26. This implies a major upside potential of 24.8% for MTB inventory from present ranges.

Moreover, the corporate’s Monetary Well being Rating is 2.8 out of 5, barely larger than Block’s, indicating a comparatively secure monetary place. This rating is supported by the financial institution’s robust capital place, constant dividend funds (present yield of two.9%), and established market presence.

Supply: Investing.com

At present valuations, the Buffalo, New York-based lender and monetary companies supplier has a market cap of $32.8 billion. Shares have climbed 44.2% prior to now yr.

Conclusion

Block and M&T Financial institution symbolize two distinct however compelling alternatives within the monetary sector.

The Money App mother or father firm provides the expansion potential of a fintech disruptor, fueled by its improvements in digital funds and cryptocurrency. In the meantime, M&T Financial institution offers stability and dependable profitability, backed by its robust regional presence and operational effectivity.

For traders seeking to seize monetary sector developments in 2025, each shares are well-positioned to ship spectacular returns.

Remember to take a look at InvestingPro to remain in sync with the market pattern and what it means in your buying and selling.

Subscribe now to get 50% off all Professional plans with our New 12 months’s vacation sale and immediately unlock entry to a number of market-beating options, together with:

ProPicks AI: AI-selected inventory winners with a confirmed monitor report.

InvestingPro Truthful Worth: Immediately discover out if a inventory is underpriced or overvalued.

Superior Inventory Screener: Seek for one of the best shares primarily based on a whole lot of chosen filters, and standards.

High Concepts: See what shares billionaire traders reminiscent of Warren Buffett, Michael Burry, and George Soros are shopping for.

Disclosure: On the time of writing, I’m lengthy on the S&P 500, and the Nasdaq 100 by way of the SPDR® S&P 500 ETF (SPY), and the Invesco QQQ Belief ETF (QQQ). I’m additionally lengthy on the Invesco High QQQ ETF (QBIG), Invesco S&P 500 Equal Weight ETF (RSP), and VanEck Vectors Semiconductor ETF (SMH).

I often rebalance my portfolio of particular person shares and ETFs primarily based on ongoing threat evaluation of each the macroeconomic setting and firms’ financials.

The views mentioned on this article are solely the opinion of the creator and shouldn’t be taken as funding recommendation.

Comply with Jesse Cohen on X/Twitter @JesseCohenInv for extra inventory market evaluation and perception.