Published on July 8th, 2025 by Bob Ciura

High dividend stocks are stocks with a dividend yield well in excess of the market average dividend yield of ~1.3%.

We define a high dividend stock as having a current yield above 5%, which is more than four times the S&P 500 average.

High-yield stocks can be very helpful to shore up income after retirement.

For example, a $120,000 investment in stocks with an average dividend yield of 5% creates an average of $500 a month in dividends.

With that in mind, we have created a free list of over 200 high dividend stocks with dividend yields above 5%.

You can download your copy of the high dividend stocks list below:

However, not all high dividend stocks are equally safe.

There are many examples of high dividend stocks reducing or eliminating their dividends. Overall, despite the positive attributes attached to high dividend stocks, their risk profile can be elevated.

In this article, we have analyzed the 10 high dividend stocks from our Sure Analysis Research Database with the safest dividends based on our Dividend Risk Score rating system.

The 10 safest high dividend stocks below have current yields above 5% and Dividend Risk Scores of ‘C’ or better.

The stocks are listed below according to their payout ratio, in ascending order.

Table of Contents

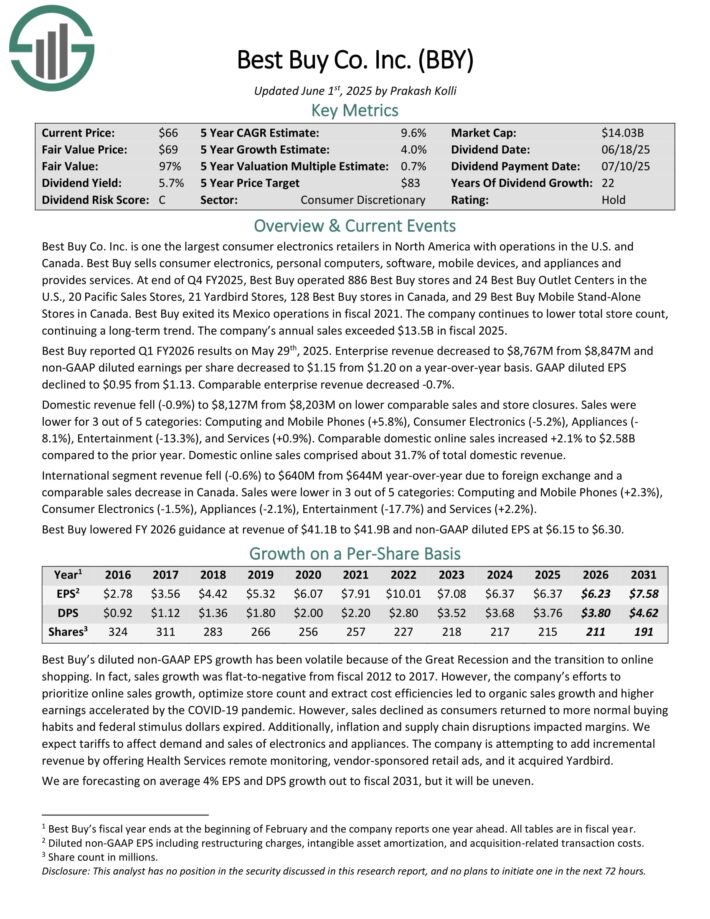

Safest High Dividend Stock #10: Best Buy Co. (BBY)

Dividend Yield: 5.4%

Payout Ratio: 61.0%

Best Buy Co. Inc. is one the largest consumer electronics retailers in North America with operations in the U.S. and Canada. Best Buy sells consumer electronics, personal computers, software, mobile devices, and appliances and provides services.

At end of Q4 FY2025, Best Buy operated 886 Best Buy stores and 24 Best Buy Outlet Centers in the U.S., 20 Pacific Sales Stores, 21 Yardbird Stores, 128 Best Buy stores in Canada, and 29 Best Buy Mobile Stand-Alone Stores in Canada. The company’s annual sales exceeded $13.5B in fiscal 2025.

Best Buy reported Q1 FY2026 results on May 29th, 2025. Enterprise revenue decreased to $8,767M from $8,847M and non-GAAP diluted earnings per share decreased to $1.15 from $1.20 on a year-over-year basis. GAAP diluted EPS declined to $0.95 from $1.13.

Comparable enterprise revenue decreased -0.7%. Domestic revenue fell -0.9% on lower comparable sales and store closures. Sales were lower for 3 out of 5 categories. Comparable domestic online sales increased 2.1% compared to the prior year. Domestic online sales comprised about 31.7% of total domestic revenue.

Click here to download our most recent Sure Analysis report on BBY (preview of page 1 of 3 shown below):

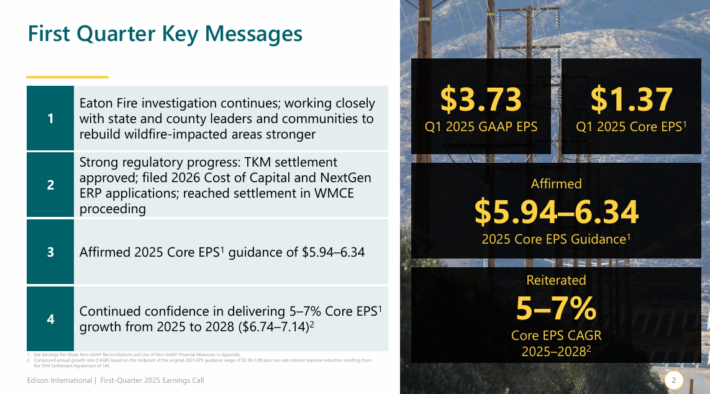

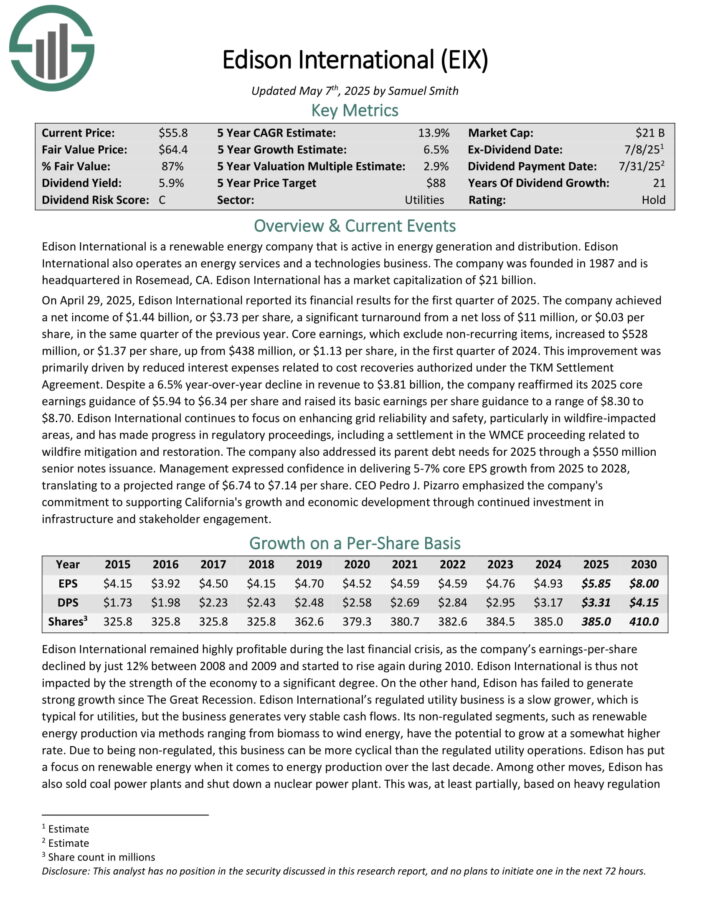

Safest High Dividend Stock #9: Edison International (EIX)

Dividend Yield: 6.5%

Payout Ratio: 56.6%

Edison International is a renewable energy company that is active in energy generation and distribution. Edison International also operates an energy services and a technologies business. The company was founded in 1987 and is headquartered in Rosemead, CA.

On April 29, 2025, Edison International reported its financial results for the first quarter of 2025. The company achieved a net income of $1.44 billion, or $3.73 per share, a significant turnaround from a net loss of $11 million, or $0.03 per share, in the same quarter of the previous year.

Source: Investor Presentation

Core earnings, which exclude non-recurring items, increased to $528 million, or $1.37 per share, up from $438 million, or $1.13 per share, in the first quarter of 2024.

This improvement was primarily driven by reduced interest expenses related to cost recoveries authorized under the TKM Settlement Agreement. Despite a 6.5% year-over-year decline in revenue to $3.81 billion, the company reaffirmed its 2025 core earnings guidance of $5.94 to $6.34 per share.

Click here to download our most recent Sure Analysis report on EIX (preview of page 1 of 3 shown below):

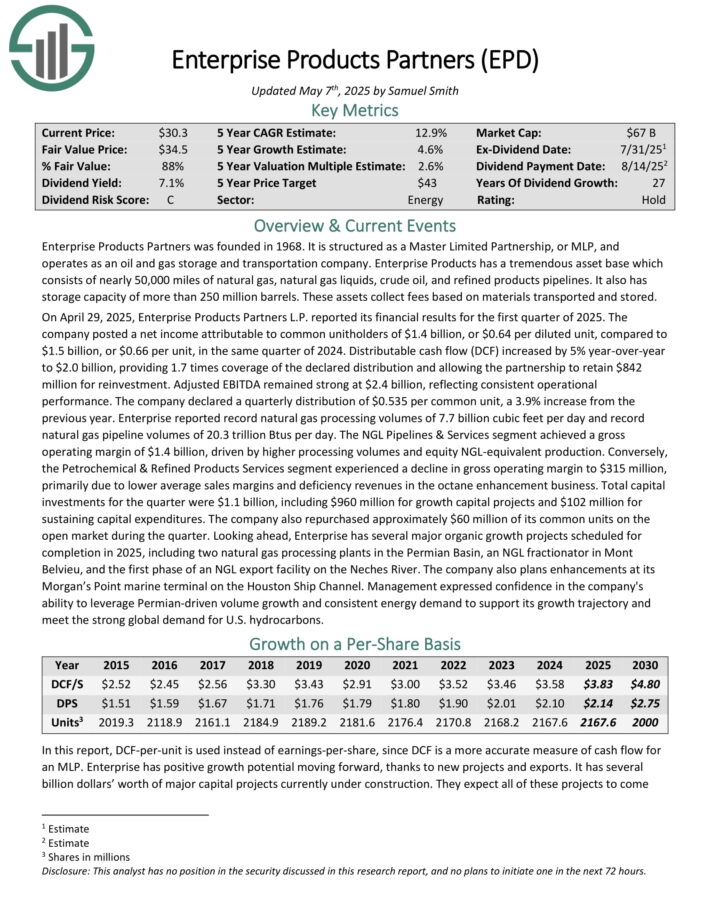

Safest High Dividend Stock #8: Enterprise Products Partners LP (EPD)

Dividend Yield: 6.8%

Payout Ratio: 55.9%

Enterprise Products Partners was founded in 1968. It is structured as a Master Limited Partnership, or MLP, and operates as an oil and gas storage and transportation company.

Enterprise Products has a large asset base which consists of nearly 50,000 miles of natural gas, natural gas liquids, crude oil, and refined products pipelines.

It also has storage capacity of more than 250 million barrels. These assets collect fees based on volumes of materials transported and stored.

Source: Investor Presentation

On April 29, 2025, Enterprise Products Partners L.P. reported its financial results for the first quarter of 2025. The company posted a net income attributable to common unitholders of $1.4 billion, or $0.64 per diluted unit, compared to $1.5 billion, or $0.66 per unit, in the same quarter of 2024.

Distributable cash flow (DCF) increased by 5% year-over-year to $2.0 billion, providing 1.7 times coverage of the declared distribution and allowing the partnership to retain $842 million for reinvestment.

Adjusted EBITDA remained strong at $2.4 billion, reflecting consistent operational performance. The company declared a quarterly distribution of $0.535 per common unit, a 3.9% increase from the previous year.

Click here to download our most recent Sure Analysis report on EPD (preview of page 1 of 3 shown below):

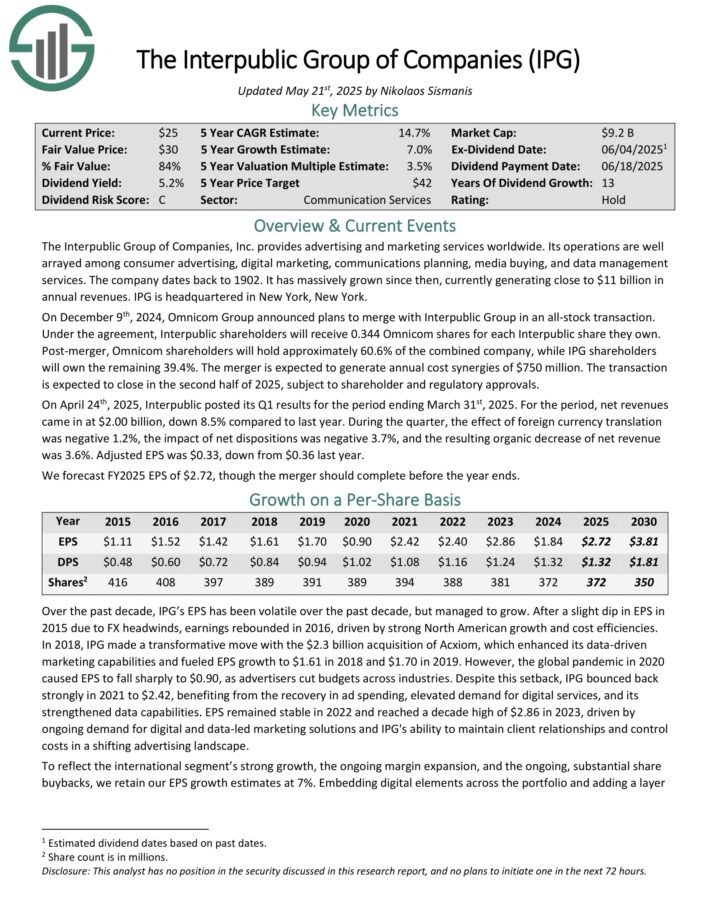

Safest High Dividend Stock #7: Interpublic Group of Cos. (IPG)

Dividend Yield: 5.2%

Payout Ratio: 48.5%

The Interpublic Group of Companies, Inc. provides advertising and marketing services worldwide. Its operations are well arrayed among consumer advertising, digital marketing, communications planning, media buying, and data management services.

The company dates back to 1902. It has massively grown since then, currently generating close to $11 billion in annual revenues. IPG is headquartered in New York, New York.

On December 9th, 2024, Omnicom Group announced plans to merge with Interpublic Group in an all-stock transaction. Under the agreement, Interpublic shareholders will receive 0.344 Omnicom shares for each Interpublic share they own.

Post-merger, Omnicom shareholders will hold approximately 60.6% of the combined company, while IPG shareholders will own the remaining 39.4%. The merger is expected to generate annual cost synergies of $750 million. The transaction is expected to close in the second half of 2025, subject to shareholder and regulatory approvals.

On April 24th, 2025, Interpublic posted its Q1 results for the period ending March 31st, 2025. For the period, net revenues came in at $2.00 billion, down 8.5% compared to last year.

During the quarter, the effect of foreign currency translation was negative 1.2%, the impact of net dispositions was negative 3.7%, and the resulting organic decrease of net revenue was 3.6%. Adjusted EPS was $0.33, down from $0.36 last year.

Click here to download our most recent Sure Analysis report on IPG (preview of page 1 of 3 shown below):

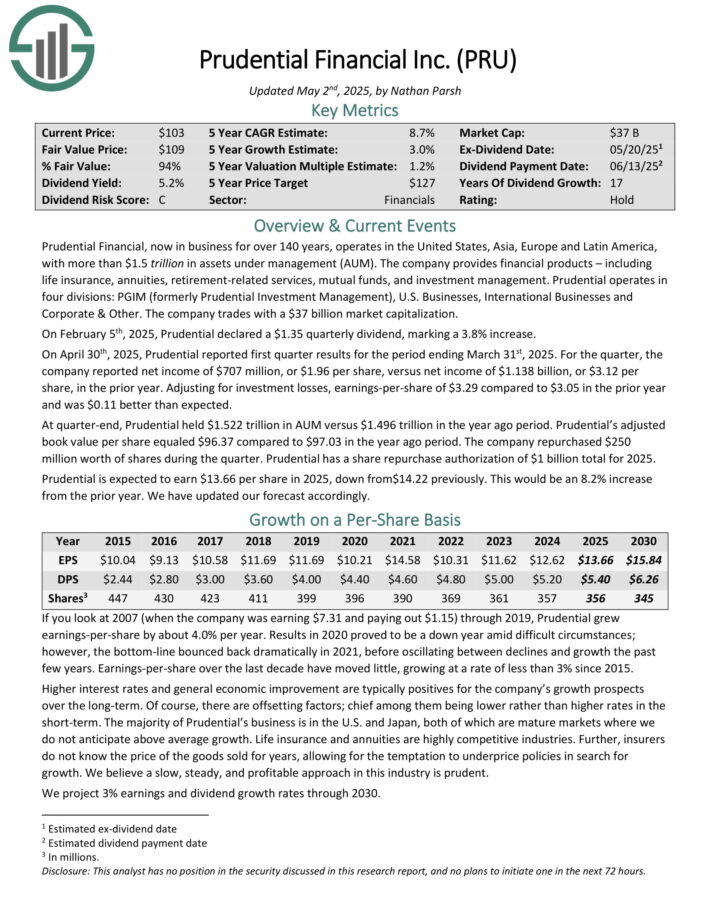

Safest High Dividend Stock #6: Prudential Financial (PRU)

Dividend Yield: 5.1%

Payout Ratio: 39.5%

Prudential Financial, now in business for over 140 years, operates in the United States, Asia, Europe and Latin America, with more than $1.5 trillion in assets under management (AUM).

The company provides financial products – including life insurance, annuities, retirement-related services, mutual funds, and investment management.

Prudential operates in four divisions: PGIM (formerly Prudential Investment Management), U.S. Businesses, International Businesses and Corporate & Other.

On April 30th, 2025, Prudential reported first quarter results for the period ending March 31st, 2025. For the quarter, the company reported net income of $707 million, or $1.96 per share, versus net income of $1.138 billion, or $3.12 per share, in the prior year.

Adjusting for investment losses, earnings-per-share of $3.29 compared to $3.05 in the prior year and was $0.11 better than expected. At quarter-end, Prudential held $1.522 trillion in AUM versus $1.496 trillion in the year ago period.

Prudential’s adjusted book value per share equaled $96.37 compared to $97.03 in the year ago period.

The company repurchased $250 million worth of shares during the quarter. Prudential has a share repurchase authorization of $1 billion total for 2025.

Click here to download our most recent Sure Analysis report on PRU (preview of page 1 of 3 shown below):

Safest High Dividend Stock #5: Canandaigua National Corporation (CNND)

Dividend Yield: 5.0%

Payout Ratio: 36.8%

Canandaigua National Corporation (CNC) is the parent company of The Canandaigua National Bank & Trust Company (CNB) and Canandaigua National Trust Company of Florida (CNTF), offering a wide range of financial services, including banking, lending, mortgage services, trust, investment management, and insurance.

With 23 branches across its service areas, CNC is focus on serving local communities by providing personalized financial solutions to individuals, businesses, and municipalities.

CNC emphasizes community banking, focusing on reinvesting in the local economy through a diverse lending portfolio. As of December 31st, 2024, CNC reported total deposits of $4.0 billion.

In early March, Canandaigua National released its full-year results for the period ending December 31st, 2024. For the year, total interest income grew 13% to $248 million.

Total interest expenses grew 29% to $111 million. Net interest income grew by 3% to $137 million. Total other income (service charges on deposit accounts and trust and investment services) increased 6% to $54 million.

Total other expenses (Inc. salaries, occupancy, and marketing) grew 6% to $125 million. Net income was $45 million, relatively flat year-over-year. EPS was $24.15.

Click here to download our most recent Sure Analysis report on CNND (preview of page 1 of 3 shown below):

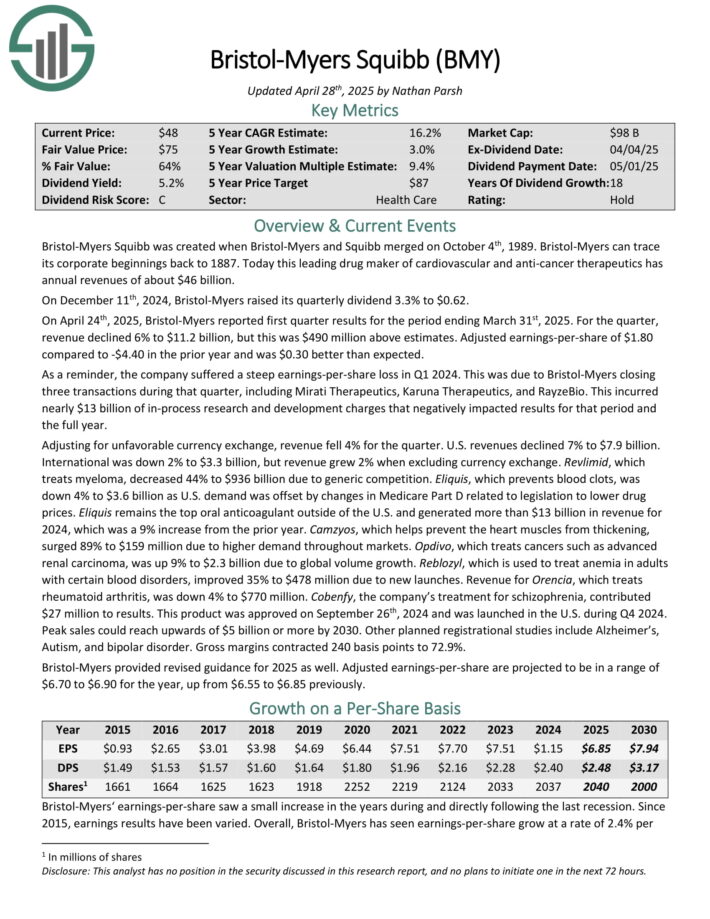

Safest High Dividend Stock #4: Bristol-Myers Squibb (BMY)

Dividend Yield: 5.3%

Payout Ratio: 36.2%

Bristol-Myers Squibb was created when Bristol-Myers and Squibb merged on October 4th, 1989. This leading drug maker of cardiovascular and anti-cancer therapeutics has annual revenues of about $46 billion.

On December 11th, 2024, Bristol-Myers raised its quarterly dividend 3.3% to $0.62.

On April 24th, 2025, Bristol-Myers reported first quarter results for the period ending March 31st, 2025. For the quarter, revenue declined 6% to $11.2 billion, but this was $490 million above estimates.

Adjusted earnings-per-share of $1.80 compared to -$4.40 in the prior year and was $0.30 better than expected. The company suffered a steep earnings-per-share loss in Q1 2024.

Adjusting for unfavorable currency exchange, revenue fell 4% for the quarter. U.S. revenues declined 7% to $7.9 billion. International was down 2% to $3.3 billion, but revenue grew 2% when excluding currency exchange.

Revlimid, which treats myeloma, decreased 44% to $936 billion due to generic competition.

Bristol-Myers provided revised guidance for 2025 as well. Adjusted earnings-per-share are projected to be in a range of $6.70 to $6.90 for the year, up from $6.55 to $6.85 previously.

Click here to download our most recent Sure Analysis report on BMY (preview of page 1 of 3 shown below):

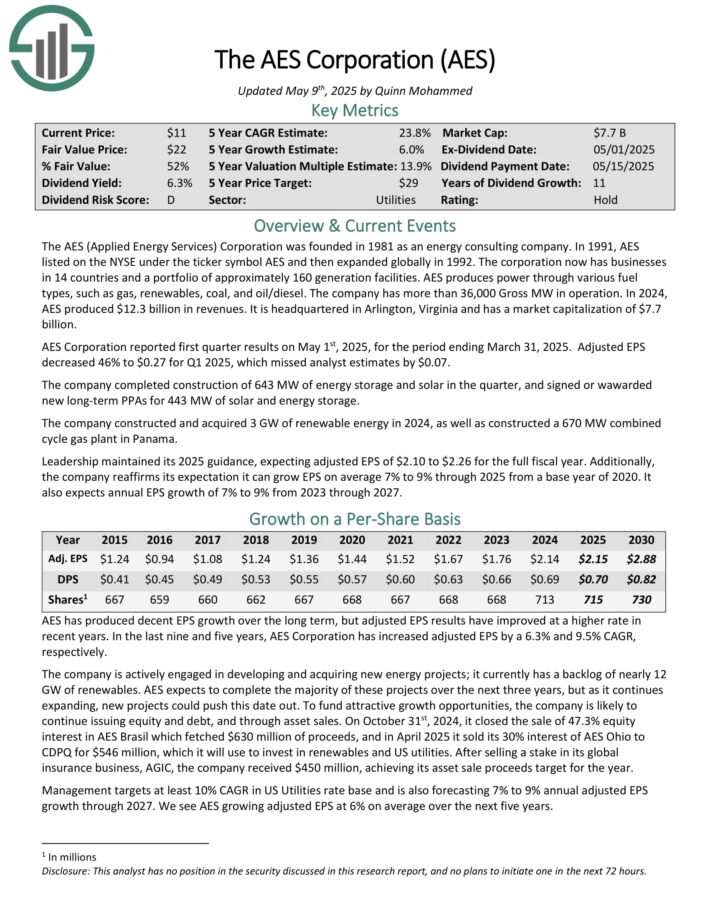

Safest High Dividend Stock #3: AES Corp. (AES)

Dividend Yield: 6.1%

Payout Ratio: 32.6%

The AES (Applied Energy Services) Corporation has businesses in 14 countries and a portfolio of approximately 160 generation facilities. AES produces power through various fuel types, such as gas, renewables, coal, and oil/diesel.

The company has more than 36,000 Gross MW in operation. In 2024, AES produced $12.3 billion in revenues.

AES Corporation reported first quarter results on May 1st, 2025, for the period ending March 31, 2025. Adjusted EPS decreased 46% to $0.27 for Q1 2025, which missed analyst estimates by $0.07.

The company completed construction of 643 MW of energy storage and solar in the quarter, and signed or wawarded new long-term PPAs for 443 MW of solar and energy storage.

The company constructed and acquired 3 GW of renewable energy in 2024, as well as constructed a 670 MW combined cycle gas plant in Panama. Leadership maintained its 2025 guidance, expecting adjusted EPS of $2.10 to $2.26 for the full fiscal year.

Click here to download our most recent Sure Analysis report on AES (preview of page 1 of 3 shown below):

Safest High Dividend Stock #2: Shutterstock, Inc. (SSTK)

Dividend Yield: 6.8%

Payout Ratio: 30.0%

Shutterstock sells high-quality creative content for brands, digital media and marketing companies through its global creative platform.

Its platform hosts the most extensive and diverse collection of high-quality 3D models, videos, music, photographs, vectors and illustrations for licensing. The company reported $935 million in revenues last year.

On January 7th, 2025, Shutterstock announced it entered a merger agreement with Getty Images through a merger of equals. The combined company will retain the name Getty Images Holdings, Inc and trade on the NYSE under ticker GETY.

Getty Images shareholders will own roughly 54.6% of the entity and Shutterstock shareholders will own the remaining 45.3%. Shareholders of SSTK will receive $28.84870 of cash, or 9.17 shares of Getty Images plus $9.50 in cash per share.

The combined company would have revenue between $1,979 million and $1,993 million, 46% of it being subscription revenue. About $175 million of annual cost savings is forecast by the third year, with most of this expected after 1 to 2 years.

On January 27th, 2025, Shutterstock announced a $0.33 quarterly dividend, a 10% increase over the prior year.

On May 2nd, 2025, Shutterstock published its first quarter results for the period ending March 31, 2025. While quarterly revenue grew by a solid 13% year-on-year, it missed analyst estimates by nearly $7 million. Adjusted EPS of $1.03 increased by 12%, and also missed analyst estimates by $0.01.

Click here to download our most recent Sure Analysis report on SSTK (preview of page 1 of 3 shown below):

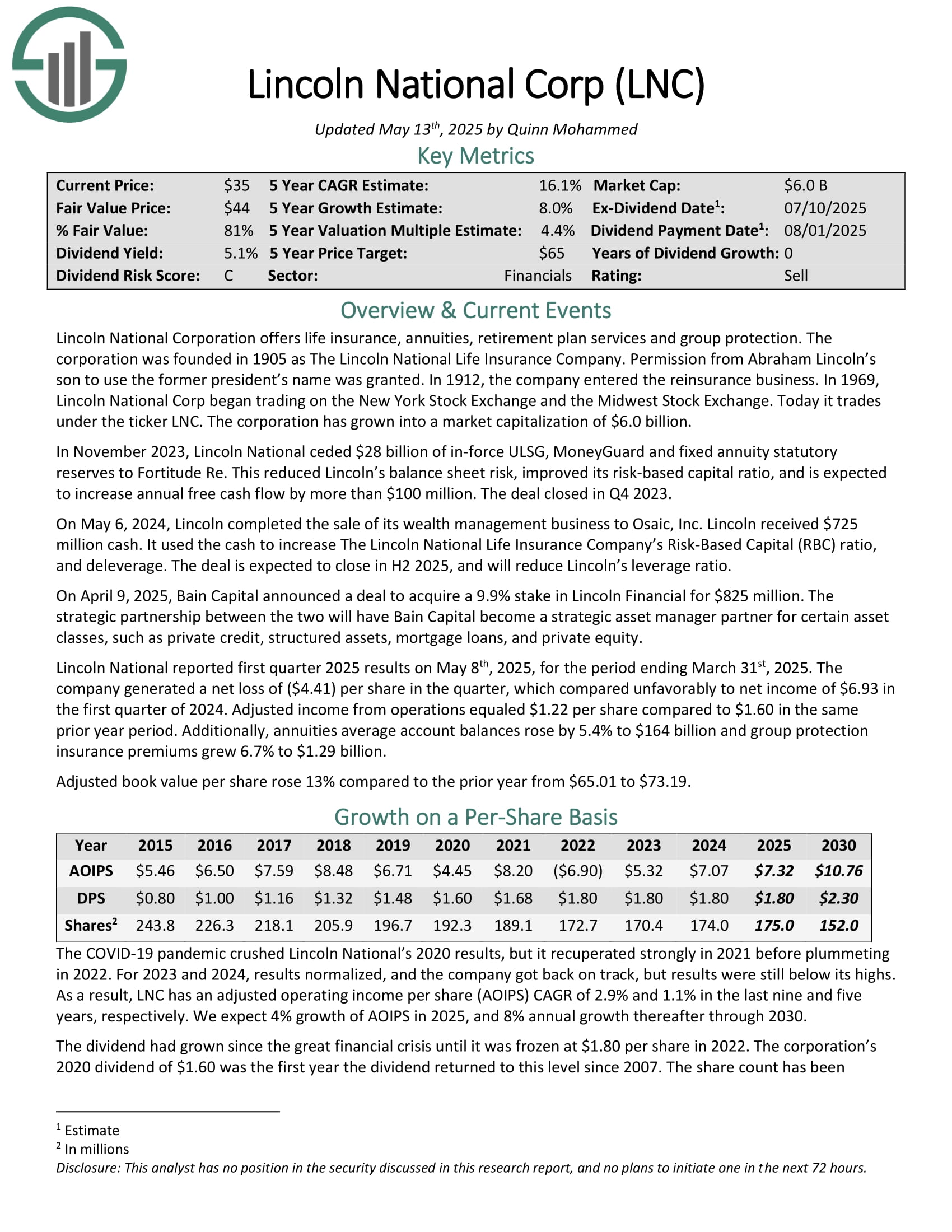

Safest High Dividend Stock #1: Lincoln National (LNC)

Dividend Yield: 5.3%

Payout Ratio: 24.6%

Lincoln National Corporation offers life insurance, annuities, retirement plan services and group protection. The corporation was founded in 1905 as The Lincoln National Life Insurance Company.

On April 9, 2025, Bain Capital announced a deal to acquire a 9.9% stake in Lincoln Financial for $825 million. The strategic partnership between the two will have Bain Capital become a strategic asset manager partner for certain asset classes, such as private credit, structured assets, mortgage loans, and private equity.

Lincoln National reported first quarter 2025 results on May 8th, 2025, for the period ending March 31st, 2025. The company generated a net loss of ($4.41) per share in the quarter, which compared unfavorably to net income of $6.93 in the first quarter of 2024.

Adjusted income from operations equaled $1.22 per share compared to $1.60 in the same prior year period.

Additionally, annuities average account balances rose by 5.4% to $164 billion and group protection insurance premiums grew 6.7% to $1.29 billion. Adjusted book value per share rose 13% compared to the prior year from $65.01 to $73.19.

Click here to download our most recent Sure Analysis report on LNC (preview of page 1 of 3 shown below):

Final Thoughts

High dividend stocks can be an attractive option for investors seeking a greater level of income from their investment portfolios.

While no investment comes without risk, some high dividend stocks have demonstrated a history of financial stability, consistent earnings, and reliable dividend payments.

High dividend stocks carry elevated risks, so investors should be sure to conduct thorough research before buying.

Additional Reading

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

And see the resources below for more compelling investment ideas for dividend growth stocks and/or high-yield investment securities.

Thanks for reading this article. Please send any feedback, corrections, or questions to support@suredividend.com.