Published on June 25th, 2025 by Bob Ciura

Monthly dividend stocks are securities that pay a dividend every month instead of quarterly or annually.

On the surface, there is a lot to like about monthly dividend stocks. Receiving 12 dividend payments per year is more appealing than traditional stocks that pay dividends quarterly, annually, or semi-annually.

With this in mind, we created a list of over 70 monthly dividend stocks, along with important financial information such as dividend yields and price-to-earnings ratios.

You can download a free copy of our monthly dividend stocks list by clicking on the link below:

However, not all monthly dividend stocks are buys. Just because a stock pays a dividend monthly, does not automatically tell investors if the dividend is secure, or if the stock will generate satisfactory total returns.

As a result, investors should look deeper to analyze a company’s fundamentals, regardless of the frequency of its dividend payouts.

This article will discuss 10 monthly dividend stocks to sell, either because their dividends are unsustainable, or they are presently overvalued and likely to produce disappointing total returns in the years ahead.

Table of Contents

You can instantly jump to any specific section of the article by using the links below:

Monthly Dividend Stock To Sell: Gladstone Commercial Corp. (GOOD)

Gladstone Commercial Corporation is a real estate investment trust, or REIT, that specializes in single-tenant and anchored multi-tenant net leased industrial and office properties across the U.S.

The trust targets primary and secondary markets that possess favorable economic growth trends, growing populations, strong employment, and robust growth trends.

The trust’s stated goal is to pay shareholders monthly distributions, which it has done for more than 17 consecutive years. Gladstone owns over 100 properties in 24 states that are leased to about 100 unique tenants.

Gladstone posted first quarter earnings on May 8th, 2025, and results were in line with expectations. Q1 funds-from operations came to 34 cents, meeting expectations. Revenue was $37.5 million, fractionally beating estimates.

This was higher than the $35.7 million from a year ago on higher recovery revenues and rental rates, partially offset by lower variable lease payments from prior property sales.

Operating expenses increased from $23.3 million to $23.9 million, reflecting inflationary pressures and higher incentive fees. Net assets grew from $1.09 billion to $1.16 billion due to new acquisitions. Cash rent collection was 100% for the entirety of the quarter.

Click here to download our most recent Sure Analysis report on GOOD (preview of page 1 of 3 shown below):

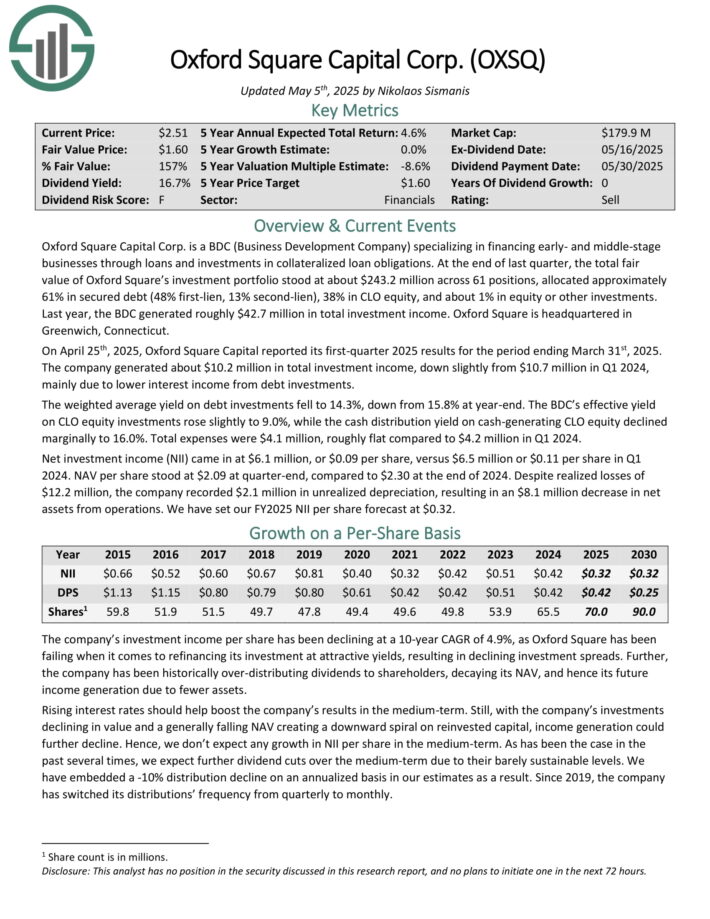

Monthly Dividend Stock To Sell: Oxford Square Capital (OXSQ)

Oxford Square Capital Corp. is a BDC (Business Development Company) specializing in financing early- and middle-stage businesses through loans and investments in collateralized loan obligations.

At the end of last quarter, the total fair value of Oxford Square’s investment portfolio stood at about $243.2 million across 61 positions, allocated approximately 61% in secured debt (48% first-lien, 13% second-lien), 38% in CLO equity, and about 1% in equity or other investments. Last year, the BDC generated roughly $42.7 million in total investment income.

On April 25th, 2025, Oxford Square Capital reported its first-quarter 2025 results for the period ending March 31st, 2025. The company generated about $10.2 million in total investment income, down slightly from $10.7 million in Q1 2024, mainly due to lower interest income from debt investments.

The weighted average yield on debt investments fell to 14.3%, down from 15.8% at year-end. The BDC’s effective yield on CLO equity investments rose slightly to 9.0%, while the cash distribution yield on cash-generating CLO equity declined marginally to 16.0%. Total expenses were $4.1 million, roughly flat compared to $4.2 million in Q1 2024.

Click here to download our most recent Sure Analysis report on OXSQ (preview of page 1 of 3 shown below):

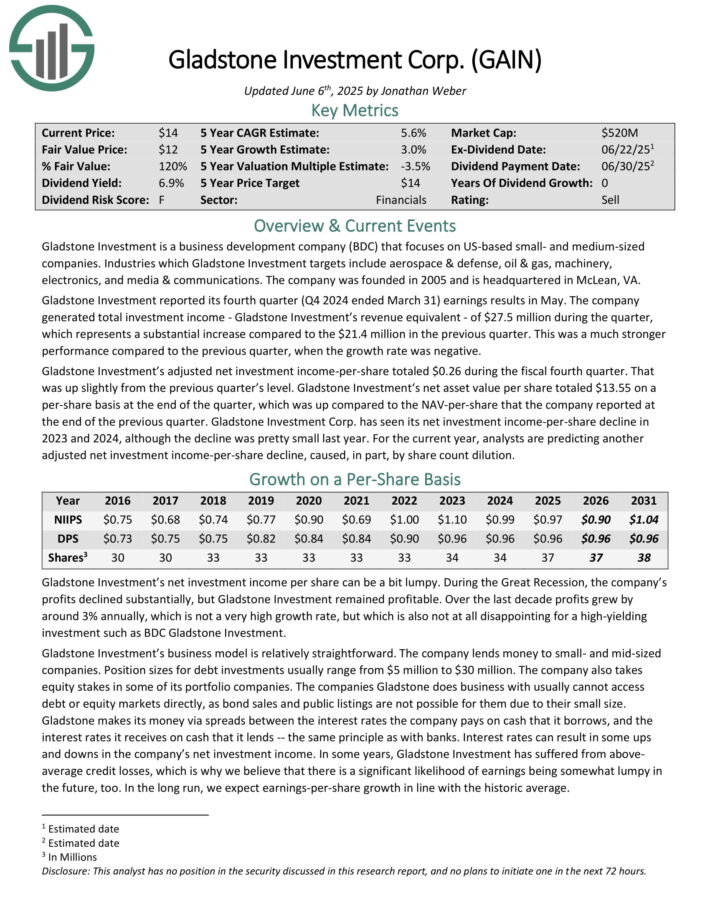

Monthly Dividend Stock To Sell: Gladstone Investment Corp. (GAIN)

Gladstone Investment is a business development company (BDC) that focuses on US-based small- and medium-sized companies.

Industries which Gladstone Investment targets include aerospace & defense, oil & gas, machinery, electronics, and media & communications.

Gladstone Investment reported its fourth quarter (Q4 2024 ended March 31) earnings results in May. The company generated total investment income – Gladstone Investment’s revenue equivalent – of $27.5 million during the quarter, which represents a substantial increase compared to the $21.4 million in the previous quarter.

This was a much stronger performance compared to the previous quarter, when the growth rate was negative. Gladstone Investment’s adjusted net investment income-per-share totaled $0.26 during the fiscal fourth quarter. That was up slightly from the previous quarter’s level.

Gladstone Investment Corp. has seen its net investment income-per-share decline in 2023 and 2024.

For the current year, analysts are predicting another adjusted net investment income-per-share decline, caused, in part, by share count dilution.

Click here to download our most recent Sure Analysis report on GAIN (preview of page 1 of 3 shown below):

Monthly Dividend Stock To Sell: Dream Industrial REIT (DREUF)

Dream Industrial REIT is an industrial REIT that owns a portfolio of urban logistics and light industrial properties. At the end of last year, the trust managed 336 assets, totaling about 72.6 million square feet of gross leasable area across Canada, the United States, and Europe.

The portfolio is primarily composed of multi-tenant buildings, with a portion in single-tenant properties, and is well-diversified across key industrial markets.

On May 6th, 2025, Dream Industrial REIT posted its Q1 results for the period ending March 31st, 2025. Total net rental income rose to about $66 million, up 6.8% year-over-year, powered by strong leasing spreads and contributions from completed developments.

Same-property net operating income increased by 3.1% to around $69.5 million, supported by a 95.4% occupancy rate and over 1.5 million square feet of leases signed at spreads averaging 23.1%.

The Trust completed a $331 million acquisition program through its joint ventures and disposed of a non-strategic asset for gross proceeds of $8.2 million. Funds from Operations (FFO) came in at $53.7 million, or $0.26 per unit, 5.8% higher year-over-year.

Click here to download our most recent Sure Analysis report on DREUF (preview of page 1 of 3 shown below):

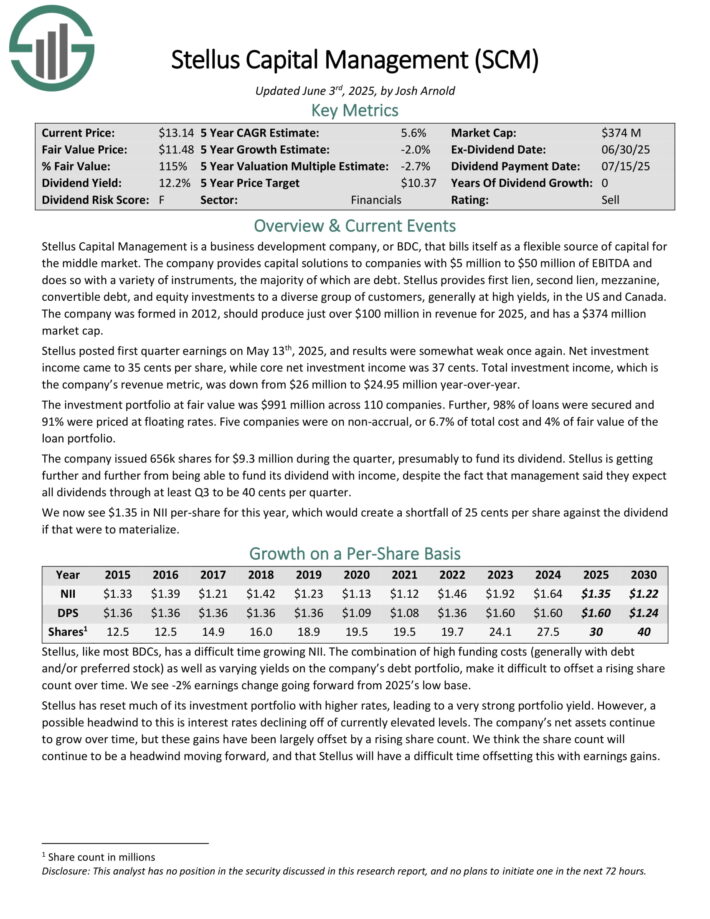

Monthly Dividend Stock To Sell: Stellus Capital (SCM)

Stellus Capital Management is a business development company, or BDC, that bills itself as a flexible source of capital for the middle market.

The company provides capital solutions to companies with $5 million to $50 million of EBITDA and does so with a variety of instruments, the majority of which are debt.

Stellus provides first lien, second lien, mezzanine, convertible debt, and equity investments to a diverse group of customers, generally at high yields, in the US and Canada.

The company was formed in 2012, should produce just over $100 million in revenue for 2025.

Stellus posted first quarter earnings on May 13th, 2025, and results were somewhat weak once again. Net investment income came to 35 cents per share, while core net investment income was 37 cents.

Total investment income, which is the company’s revenue metric, was down from $26 million to $24.95 million year-over-year. The investment portfolio at fair value was $991 million across 110 companies.

The company issued 656k shares for $9.3 million during the quarter, presumably to fund its dividend. Stellus is getting further and further from being able to fund its dividend with income.

Click here to download our most recent Sure Analysis report on SCM (preview of page 1 of 3 shown below):

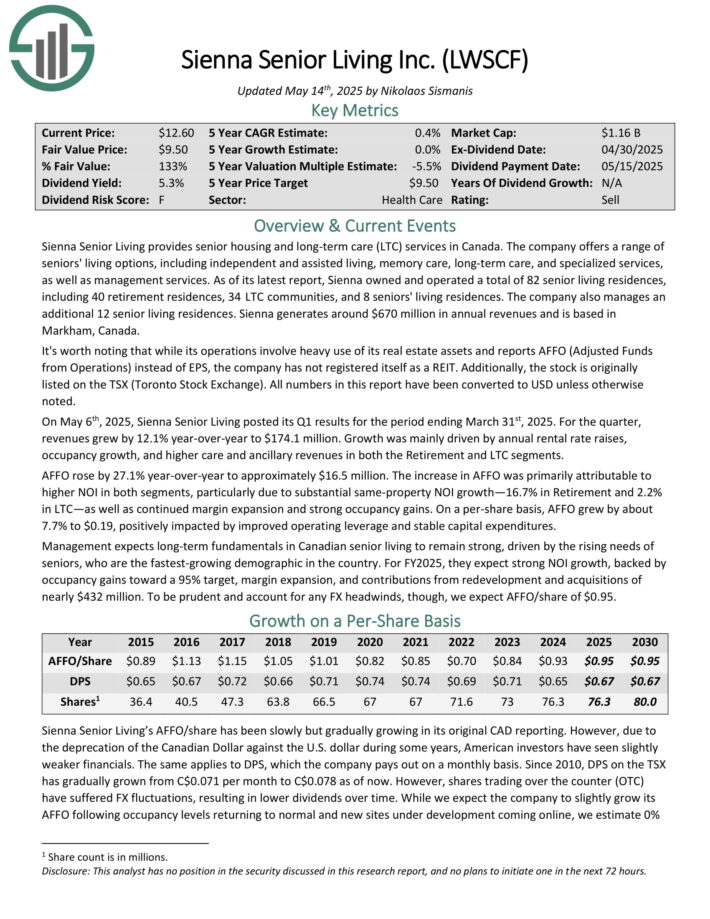

Monthly Dividend Stock To Sell: Sienna Senior Living (LWSCF)

Sienna Senior Living provides senior housing and long-term care (LTC) services in Canada. The company offers a range of seniors’ living options, including independent and assisted living, memory care, long-term care, and specialized services, as well as management services.

As of its latest report, Sienna owned and operated a total of 82 senior living residences, including 40 retirement residences, 34 LTC communities, and 8 seniors’ living residences. The company also manages an additional 12 senior living residences. Sienna generates around $670 million in annual revenues and is based in Markham, Canada.

On May 6th, 2025, Sienna Senior Living posted its Q1 results for the period ending March 31st, 2025. For the quarter, revenues grew by 12.1% year-over-year to $174.1 million. Growth was mainly driven by annual rental rate raises, occupancy growth, and higher care and ancillary revenues in both the Retirement and LTC segments.

AFFO rose by 27.1% year-over-year to approximately $16.5 million. The increase in AFFO was primarily attributable to higher NOI in both segments, particularly due to substantial same-property NOI growth—16.7% in Retirement and 2.2% in LTC—as well as continued margin expansion and strong occupancy gains.

Click here to download our most recent Sure Analysis report on LWSCF (preview of page 1 of 3 shown below):

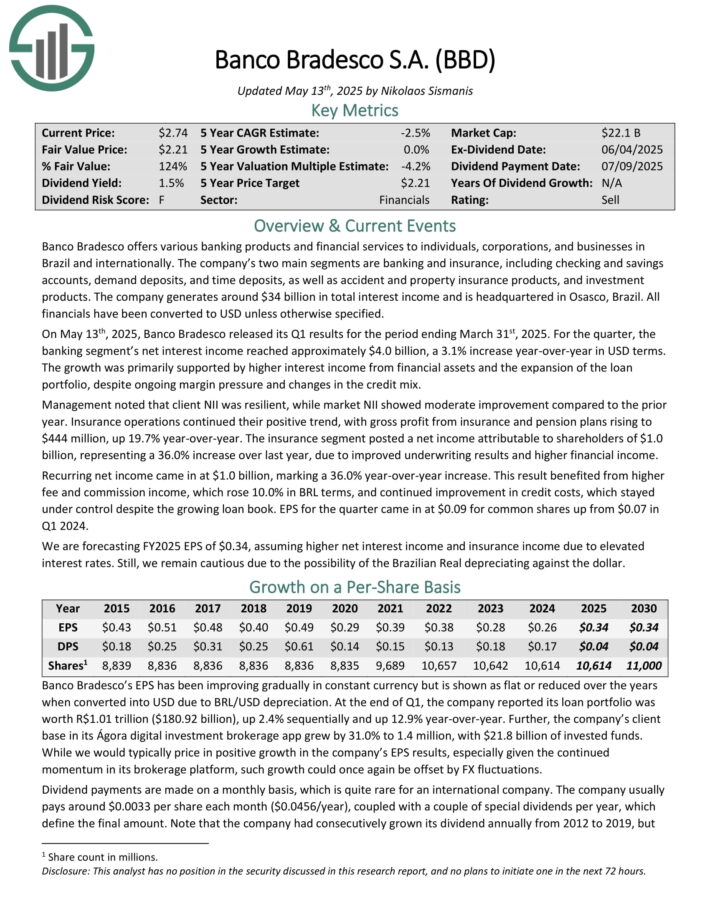

Monthly Dividend Stock To Sell: Banco Bradesco S.A. (BBD)

Banco Bradesco offers various banking products and financial services to individuals, corporations, and businesses in Brazil and internationally.

Its two main segments are banking and insurance, including checking and savings accounts, demand deposits, and time deposits, as well as accident and property insurance products, and investment products.

The company generates around $34 billion in total interest income and is headquartered in Osasco, Brazil. All financials have been converted to USD unless otherwise specified.

On May 13th, 2025, Banco Bradesco released its Q1 results for the period ending March 31st, 2025. For the quarter, the banking segment’s net interest income reached approximately $4.0 billion, a 3.1% increase year-over-year in USD terms.

The growth was primarily supported by higher interest income from financial assets and the expansion of the loan portfolio, despite ongoing margin pressure and changes in the credit mix.

Management noted that client NII was resilient, while market NII showed moderate improvement compared to the prior year. Insurance operations continued their positive trend, with gross profit from insurance and pension plans rising to $444 million, up 19.7% year-over-year.

Click here to download our most recent Sure Analysis report on BBD (preview of page 1 of 3 shown below):

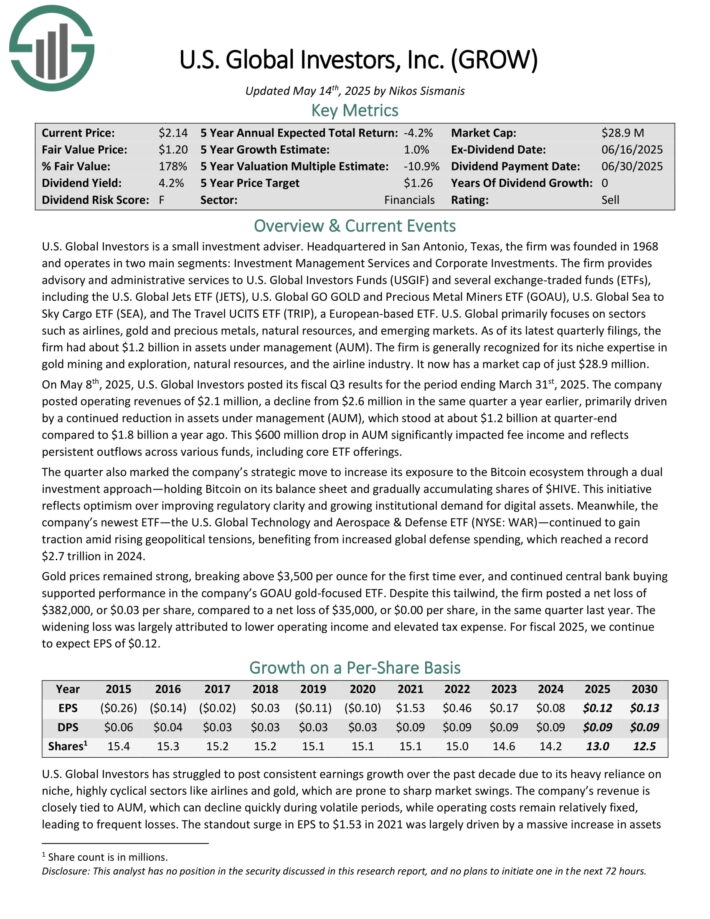

Monthly Dividend Stock To Sell: U.S. Global Investors (GROW)

U.S. Global Investors is a small investment adviser. Headquartered in San Antonio, Texas, the firm was founded in 1968 and operates in two main segments: Investment Management Services and Corporate Investments.

The firm provides advisory and administrative services to U.S. Global Investors Funds (USGIF) and several exchange-traded funds (ETFs).

As of its latest quarterly filings, the firm had about $1.2 billion in assets under management (AUM). The firm is generally recognized for its niche expertise in gold mining and exploration, natural resources, and the airline industry. It now has a market cap of just $28.9 million.

On May 8th, 2025, U.S. Global Investors posted its fiscal Q3 results for the period ending March 31st, 2025. The company posted operating revenues of $2.1 million, a decline from $2.6 million in the same quarter a year earlier.

The decline was primarily driven by a continued reduction in assets under management (AUM), which stood at about $1.2 billion at quarter-end compared to $1.8 billion a year ago.

This $600 million drop in AUM significantly impacted fee income and reflects persistent outflows across various funds, including core ETF offerings.

Click here to download our most recent Sure Analysis report on GROW (preview of page 1 of 3 shown below):

Monthly Dividend Stock To Sell Fortitude Gold Corp. (FTCO)

Fortitude Gold Corporation was spun-off from Gold Resource Corporation into a separate public company in December 2021. Fortitude Gold is a junior gold producer with operations in Nevada, U.S.A, one of the world’s premier mining friendly jurisdictions.

The company targets high-grade gold open pit heap leach operations averaging one gram per tonne of gold or greater. Its property portfolio currently consists of 100% ownership in seven high-grade gold properties.

All seven properties are within an approximate 30-mile radius of one another within the prolific Walker Lane Mineral Belt. The company generated $37.3 million in revenues last year, the majority of which were from gold, and is based in Colorado Springs, Colorado.

On April 29th, 2025, Fortitude Gold released its first-quarter 2025 results for the period ending March 31st, 2025. For the quarter, revenues came in at $6.5 million, marking a 20% decline compared to Q1 2024.

The decrease in revenue was largely due to a 41% drop in gold sales volume and a 26% decrease in silver sales volume. These declines were partially offset by a 38% increase in gold prices and a 38% increase in silver prices.

Moving to the bottom line, Fortitude reported a mine gross profit of $3.3 million compared to $4.2 million the previous year, reflecting the lower net sales. The company also announced a reduction in its monthly dividend from $0.04 to $0.01 per share, effective with the May 2025 payment.

Click here to download our most recent Sure Analysis report on FTCO (preview of page 1 of 3 shown below):

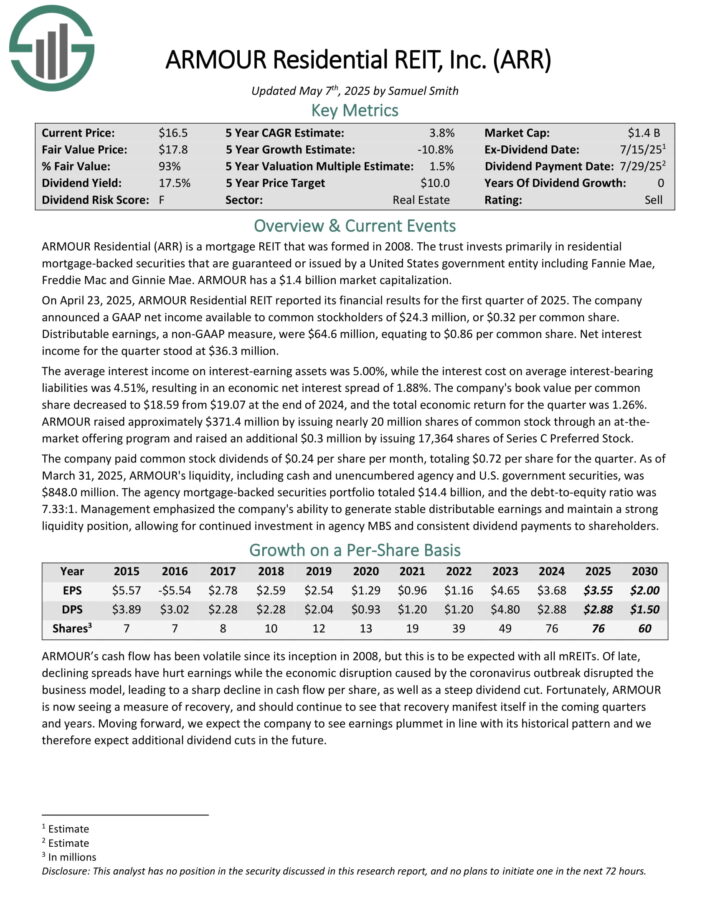

Monthly Dividend Stock To Sell: ARMOUR Residential REIT (ARR)

Annual Expected Return: 4.3%

ARMOUR Residential invests in residential mortgage-backed securities that include U.S. Government-sponsored entities (GSE) such as Fannie Mae and Freddie Mac.

It also includes Ginnie Mae, the Government National Mortgage Administration’s issued or guaranteed securities backed by fixed-rate, hybrid adjustable-rate, and adjustable-rate home loans.

Unsecured notes and bonds issued by the GSE and the US Treasury, money market instruments, and non-GSE or government agency-backed securities are examples of other types of investments.

On April 23, 2025, ARMOUR Residential REIT reported its financial results for the first quarter of 2025. The company announced a GAAP net income available to common stockholders of $24.3 million, or $0.32 per common share.

Distributable earnings, a non-GAAP measure, were $64.6 million, equating to $0.86 per common share. Net interest income for the quarter stood at $36.3 million.

The average interest income on interest-earning assets was 5.00%, while the interest cost on average interest-bearing liabilities was 4.51%, resulting in an economic net interest spread of 1.88%. The company’s book value per common share decreased to $18.59 from $19.07 at the end of 2024, and the total economic return for the quarter was 1.26%.

Click here to download our most recent Sure Analysis report on ARMOUR Residential REIT Inc (ARR) (preview of page 1 of 3 shown below):

Final Thoughts & Additional Reading

Monthly dividend stocks are instantly appealing for income investors, due to their more frequent payouts.

But income investors should always do their research to make sure they are not purchasing overvalued stocks, or stocks with unsustainable dividends.

Additionally, see the resources below for more compelling investment ideas for dividend growth stocks and/or high-yield investment securities.

Thanks for reading this article. Please send any feedback, corrections, or questions to support@suredividend.com.