Revealed on January ninth, 2025 by Bob Ciura

Dividends are a welcome signal for dividend buyers.

And dividend development is much more appreciated.

When a inventory’s dividend per share is elevated, shareholders get a lift to their passive revenue – with out lifting a finger.

Dividend development is measured in:

Years of consecutive will increase

Proportion or compound improve over quite a few years.

All different issues being equal, longer streaks and higher proportion will increase are most well-liked.

Longer streaks are most well-liked as a result of they present an organization can improve dividends over a variety of financial and aggressive environments. They present proof of a sturdy aggressive benefit. It’s no small feat to spice up a dividend year-after-year for many years at a time, by recessions, wars, and epidemics.

Better proportion dividend will increase are most well-liked as a result of they present that the corporate is keen and capable of pay extra to shareholders. This can be a signal administration expects money stream development and stability on a per share foundation.

With all this in thoughts, we created an inventory of all 66 Dividend Aristocrats, a gaggle of shares within the S&P 500 Index, with 25+ years of dividend will increase.

There are at the moment 66 Dividend Aristocrats. You possibly can obtain an Excel spreadsheet of all 66 Dividend Aristocrats (with metrics that matter comparable to dividend yields and price-to-earnings ratios) by clicking the hyperlink beneath:

Disclaimer: Positive Dividend will not be affiliated with S&P International in any manner. S&P International owns and maintains The Dividend Aristocrats Index. The data on this article and downloadable spreadsheet relies on Positive Dividend’s personal evaluation, abstract, and evaluation of the S&P 500 Dividend Aristocrats ETF (NOBL) and different sources, and is supposed to assist particular person buyers higher perceive this ETF and the index upon which it’s based mostly. Not one of the data on this article or spreadsheet is official information from S&P International. Seek the advice of S&P International for official data.

And since dividends are paid with precise money, they will’t be faked. An organization can’t pay dividends out of fictional earnings.

An organization can’t pay dividends for any significant size of time with out producing money flows to assist the dividend.

Dividend development is a robust sign of an organization’s monetary well being, administration’s confidence, and dedication to long-term worth creation.

The next record is comprised of the ten greatest dividend shares utilizing the dividend development sign.

These 10 Dividend Aristocrats had been chosen based mostly on their projected future 5-year annual earnings-per-share development within the Positive Evaluation Analysis Database.

The shares are ranked by 5-year anticipated EPS development charges, from lowest to highest.

Desk of Contents

You possibly can immediately bounce to any particular part of the article by clicking on the hyperlinks beneath:

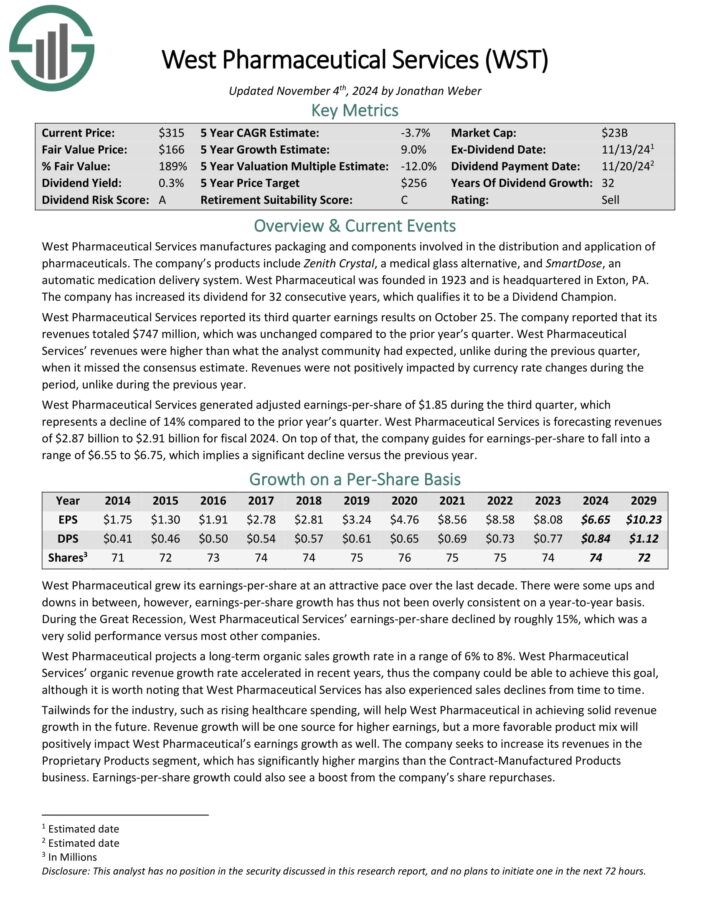

Finest Inventory Utilizing the Dividend Development Sign: West Pharmaceutical Companies (WST)

West Pharmaceutical Companies manufactures packaging and elements concerned within the distribution and software of prescription drugs. The corporate’s merchandise embrace Zenith Crystal, a medical glass different, and SmartDose, an computerized treatment supply system.

West Pharmaceutical Companies reported its second quarter earnings outcomes on July 25. The corporate reported that its revenues totaled $702 million, which represents a income decline of seven% in comparison with the prior yr’s quarter.

West Pharmaceutical Companies’ revenues had been decrease than what the analyst group had anticipated, not like throughout the earlier quarter, when it beat the consensus estimate. Revenues weren’t positively impacted by forex charge adjustments throughout the interval, not like throughout the earlier yr.

West Pharmaceutical Companies generated adjusted earnings-per-share of $1.52 throughout the second quarter, which represents a decline of 28% in comparison with the prior yr’s quarter.

Click on right here to obtain our most up-to-date Positive Evaluation report on WST (preview of web page 1 of three proven beneath):

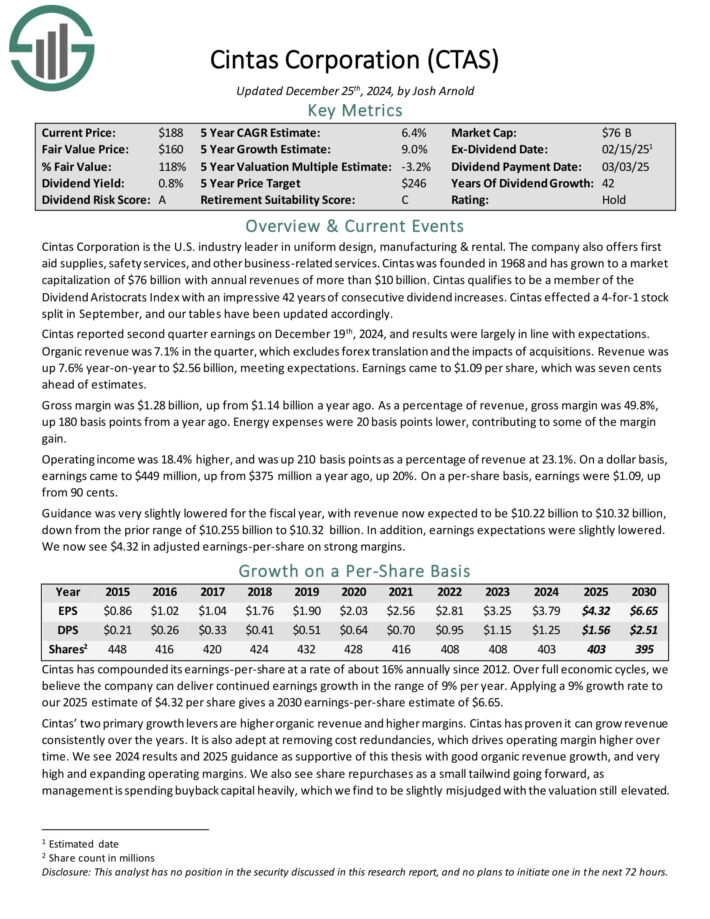

Finest Inventory Utilizing the Dividend Development Sign: Cintas Company (CTAS)

Cintas Company is the U.S. business chief in uniform design, manufacturing & rental. The corporate additionally provides first support provides, security providers, and different business-related providers.

Cintas reported second quarter earnings on December nineteenth, 2024, and outcomes had been largely in keeping with expectations. Natural income was 7.1% within the quarter, which excludes foreign exchange translation and the impacts of acquisitions.

Income was up 7.6% year-on-year to $2.56 billion, assembly expectations. Earnings got here to $1.09 per share, which was seven cents forward of estimates.

Gross margin was $1.28 billion, up from $1.14 billion a yr in the past. As a proportion of income, gross margin was 49.8%, up 180 foundation factors from a yr in the past. Power bills had been 20 foundation factors decrease, contributing to among the margin acquire.

Working revenue was 18.4% greater, and was up 210 foundation factors as a proportion of income at 23.1%. On a greenback foundation, earnings got here to $449 million, up from $375 million a yr in the past, up 20%. On a per-share foundation, earnings had been $1.09, up from 90 cents.

Click on right here to obtain our most up-to-date Positive Evaluation report on CTAS (preview of web page 1 of three proven beneath):

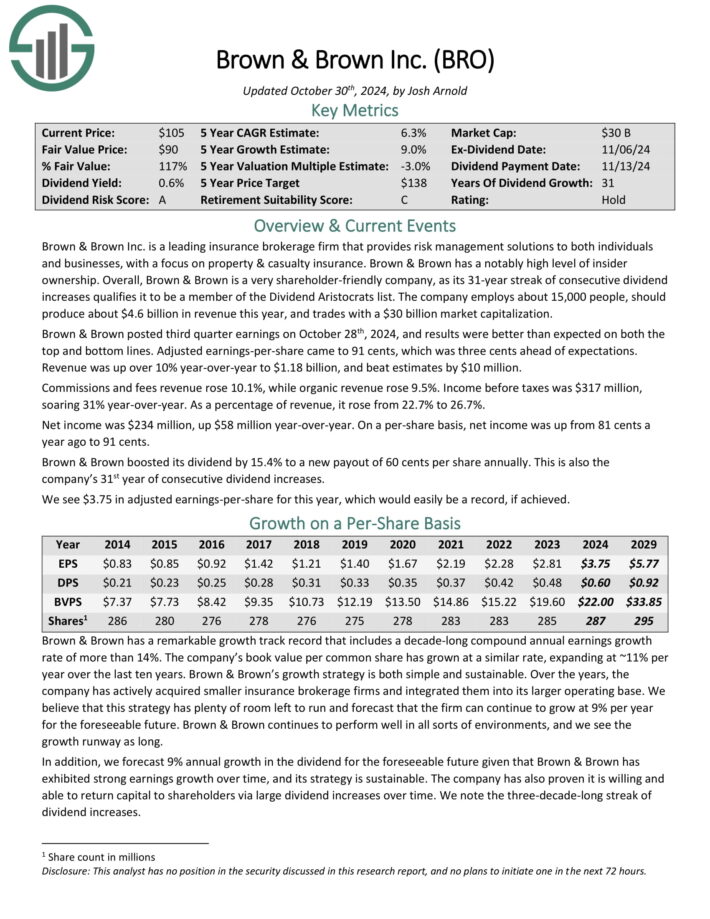

Finest Inventory Utilizing the Dividend Development Sign: Brown & Brown Inc. (BRO)

Brown & Brown Inc. is a number one insurance coverage brokerage agency that gives danger administration options to each people and companies, with a give attention to property & casualty insurance coverage. Brown & Brown has a notably excessive stage of insider possession.

Brown & Brown posted third quarter earnings on October twenty eighth, 2024, and outcomes had been higher than anticipated on each the highest and backside traces. Adjusted earnings-per-share got here to 91 cents, which was three cents forward of expectations.

Income was up over 10% year-over-year to $1.18 billion, and beat estimates by $10 million. Commissions and costs income rose 10.1%, whereas natural income rose 9.5%. Earnings earlier than taxes was $317 million, hovering 31% year-over-year. As a proportion of income, it rose from 22.7% to 26.7%.

Internet revenue was $234 million, up $58 million year-over-year. On a per-share foundation, internet revenue was up from 81 cents a yr in the past to 91 cents. Brown & Brown boosted its dividend by 15.4% to a brand new payout of 60 cents per share yearly. That is additionally the corporate’s thirty first yr of consecutive dividend will increase.

Its aggressive benefit comes from its willingness to execute small and frequent acquisitions. This growth-by-acquisition technique offers the corporate an everlasting alternative to proceed rising its enterprise for the foreseeable future.

Click on right here to obtain our most up-to-date Positive Evaluation report on BRO (preview of web page 1 of three proven beneath):

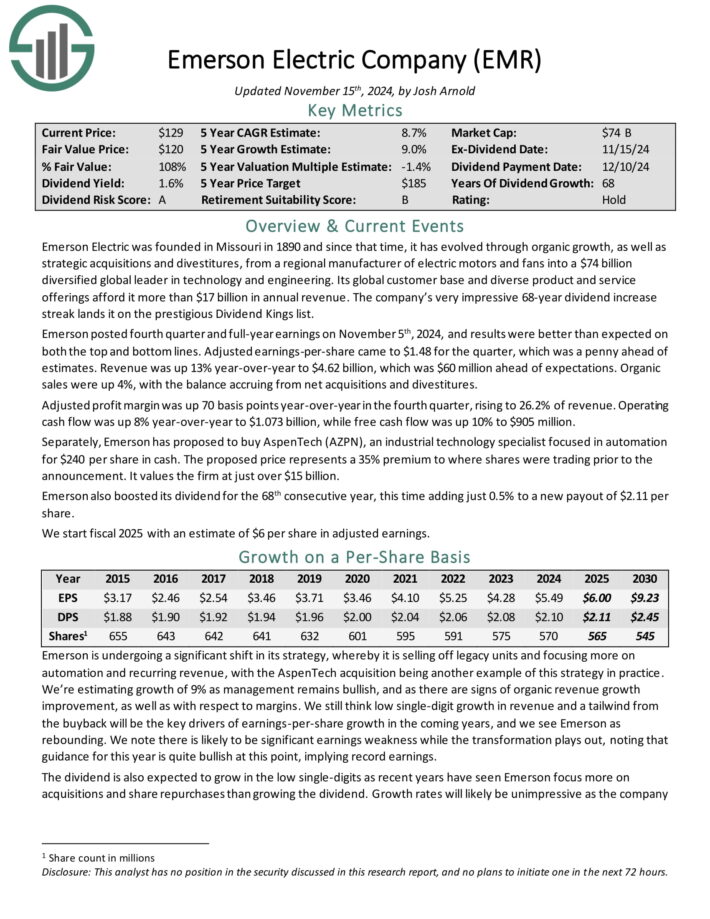

Finest Inventory Utilizing the Dividend Development Sign: Emerson Electrical Co. (EMR)

Emerson Electrical is a diversified international chief in expertise and engineering. Its international buyer base and numerous product and repair choices afford it greater than $17 billion in annual income.

Emerson posted fourth quarter and full-year earnings on November fifth, 2024, and outcomes had been higher than anticipated on each the highest and backside traces. Adjusted earnings-per-share got here to $1.48 for the quarter, which was a penny forward of estimates.

Income was up 13% year-over-year to $4.62 billion, which was $60 million forward of expectations. Natural gross sales had been up 4%, with the stability accruing from internet acquisitions and divestitures.

Adjusted revenue margin was up 70 foundation factors year-over-year within the fourth quarter, rising to 26.2% of income. Working money stream was up 8% year-over-year to $1.073 billion, whereas free money stream was up 10% to $905 million.

Emerson additionally boosted its dividend for the 68th consecutive yr.

Click on right here to obtain our most up-to-date Positive Evaluation report on EMR (preview of web page 1 of three proven beneath):

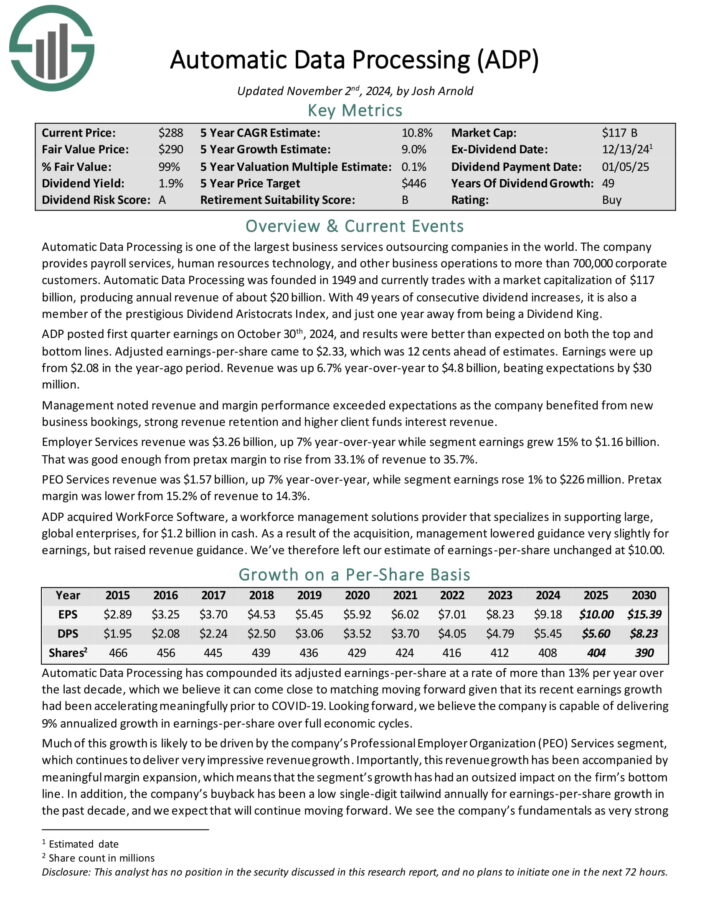

Finest Inventory Utilizing the Dividend Development Sign: Automated Information Processing, Inc. (ADP)

Automated Information Processing is among the largest enterprise providers outsourcing corporations on the planet. The corporate supplies payroll providers, human sources expertise, and different enterprise operations to greater than 700,000 company prospects.

ADP posted first quarter earnings on October thirtieth, 2024, and outcomes had been higher than anticipated on each the highest and backside traces. Adjusted earnings-per-share got here to $2.33, which was 12 cents forward of estimates.

Earnings had been up from $2.08 within the year-ago interval. Income was up 6.7% year-over-year to $4.8 billion, beating expectations by $30 million.

Administration famous income and margin efficiency exceeded expectations as the corporate benefited from new enterprise bookings, sturdy income retention and better consumer funds curiosity income.

Employer Companies income was $3.26 billion, up 7% year-over-year whereas section earnings grew 15% to $1.16 billion. That was adequate from pretax margin to rise from 33.1% of income to 35.7%.

Click on right here to obtain our most up-to-date Positive Evaluation report on ADP (preview of web page 1 of three proven beneath):

Finest Inventory Utilizing the Dividend Development Sign: Roper Applied sciences (ROP)

Roper Applied sciences is a specialised industrial firm that manufactures merchandise comparable to medical and scientific imaging gear, pumps, and materials evaluation gear.

Roper Applied sciences additionally develops software program options for the healthcare, transportation, meals, power, and water industries. The corporate was based in 1981, generates round $5.4 billion in annual revenues, and relies in Sarasota, Florida.

On October twenty third, 2024, Roper posted its Q3 outcomes for the interval ending September thirtieth, 2024. Quarterly revenues and adjusted EPS had been $1.76 billion and $4.62, indicating a year-over-year improve of 13% and seven%, respectively.

The corporate’s momentum throughout the quarter remained sturdy, with natural development coming in at 4% and acquisitions additional boosting top-line development.

Natural development was as soon as once more pushed by broad-based power throughout its portfolio of niche-leading companies.

Click on right here to obtain our most up-to-date Positive Evaluation report on ROP (preview of web page 1 of three proven beneath):

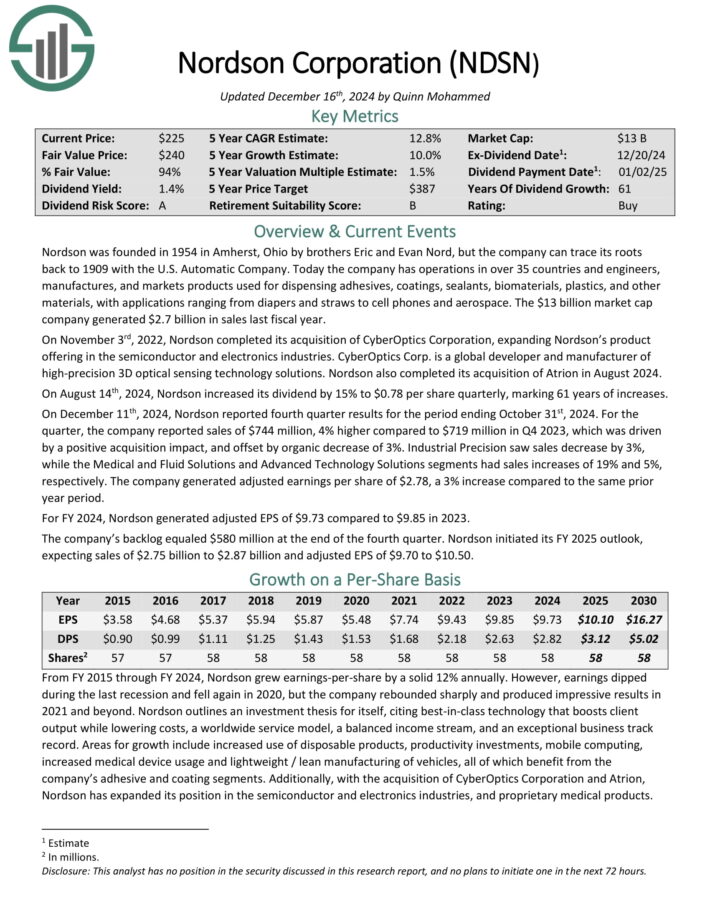

Finest Inventory Utilizing the Dividend Development Sign: Nordson Corp. (NDSN)

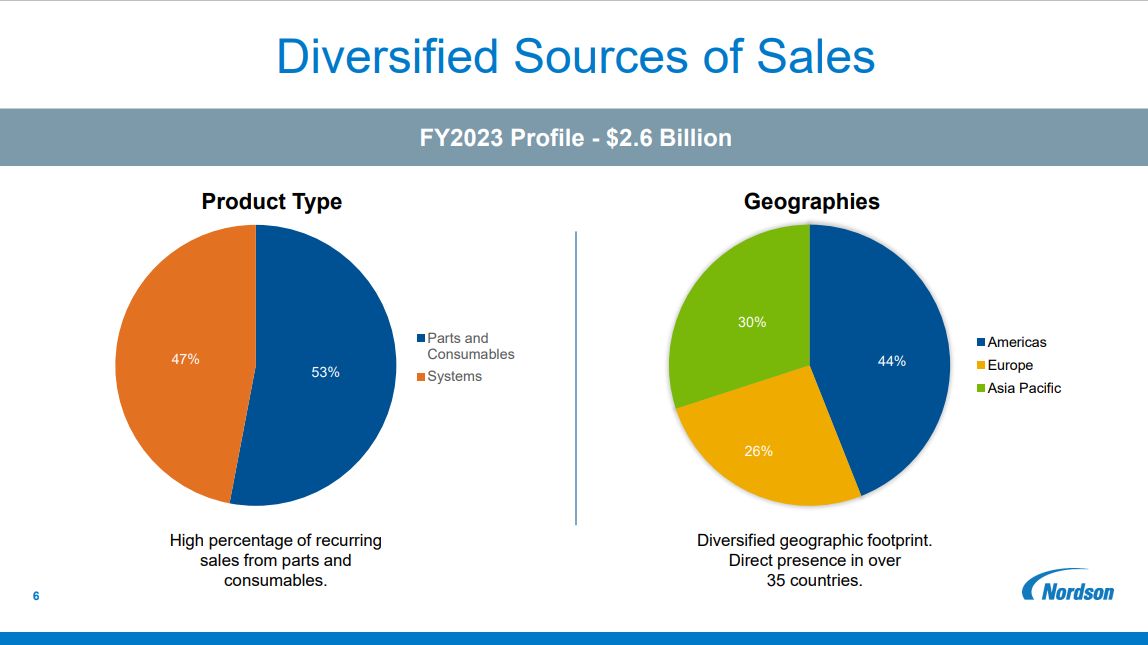

Nordson was based in 1954 in Amherst, Ohio by brothers Eric and Evan Nord, however the firm can hint its roots again to 1909 with the U.S. Automated Firm.

At this time the corporate has operations in over 35 nations and engineers, manufactures, and markets merchandise used for shelling out adhesives, coatings, sealants, biomaterials, plastics, and different supplies, with functions starting from diapers and straws to cell telephones and aerospace.

Supply: Investor Presentation

On August 14th, 2024, Nordson elevated its dividend by 15% to $0.78 per share quarterly, marking 61 years of will increase.

On December eleventh, 2024, Nordson reported fourth quarter outcomes for the interval ending October thirty first, 2024. For the quarter, the corporate reported gross sales of $744 million, 4% greater in comparison with $719 million in This autumn 2023, which was pushed by a optimistic acquisition affect, and offset by natural lower of three%.

Industrial Precision noticed gross sales lower by 3%, whereas the Medical and Fluid Options and Superior Know-how Options segments had gross sales will increase of 19% and 5%, respectively. The corporate generated adjusted earnings per share of $2.78, a 3% improve in comparison with the identical prior-year quarter.

Click on right here to obtain our most up-to-date Positive Evaluation report on NDSN (preview of web page 1 of three proven beneath):

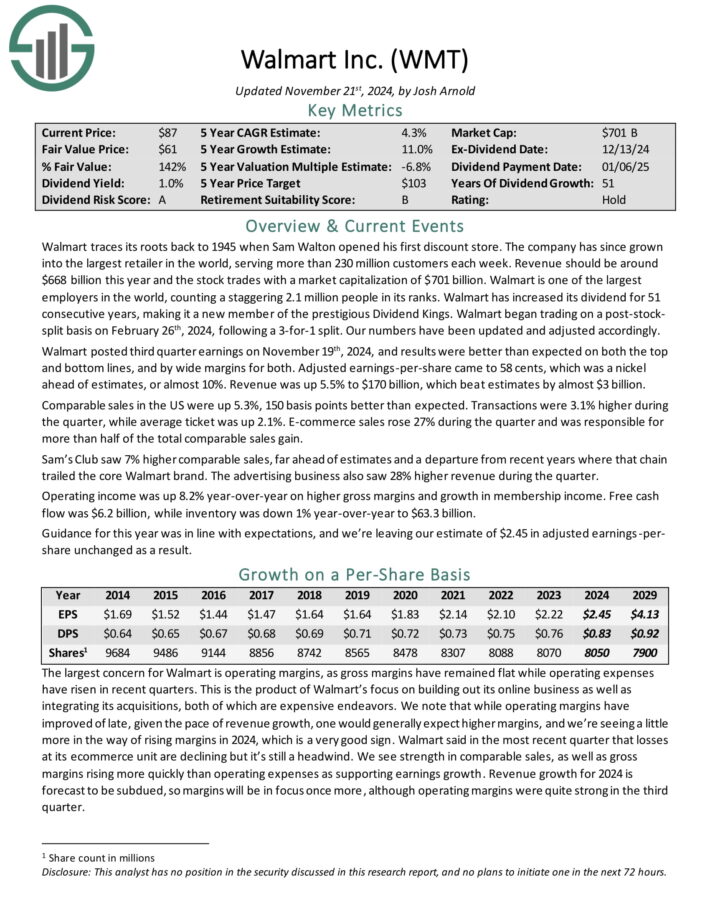

Finest Inventory Utilizing the Dividend Development Sign: Walmart Inc. (WMT)

Walmart traces its roots again to 1945 when Sam Walton opened his first low cost retailer. The corporate has since grown into one of many largest retailers on the planet, serving over 230 million prospects every week. Income will probably be round $600 billion this yr.

Walmart posted second quarter earnings on August fifteenth, 2024, and outcomes had been wonderful, sending the inventory hovering. Adjusted earnings-per-share beat estimates by two cents at 67 cents. Income was up nearly 5% year-over-year to $169.3 billion, and beat estimates by nearly $2 billion.

Walmart posted third quarter earnings on November nineteenth, 2024, and outcomes had been higher than anticipated on each the highest and backside traces, and by extensive margins for each.

Adjusted earnings-per-share got here to 58 cents, which was a nickel forward of estimates, or nearly 10%. Income was up 5.5% to $170 billion, which beat estimates by nearly $3 billion.

Comparable gross sales within the US had been up 5.3%, 150 foundation factors higher than anticipated. Transactions had been 3.1% greater throughout the quarter, whereas common ticket was up 2.1%.

E-commerce gross sales rose 27% throughout the quarter and was accountable for greater than half of the full comparable gross sales acquire.

Click on right here to obtain our most up-to-date Positive Evaluation report on Walmart (preview of web page 1 of three proven beneath):

Finest Inventory Utilizing the Dividend Development Sign: Ecolab, Inc. (ECL)

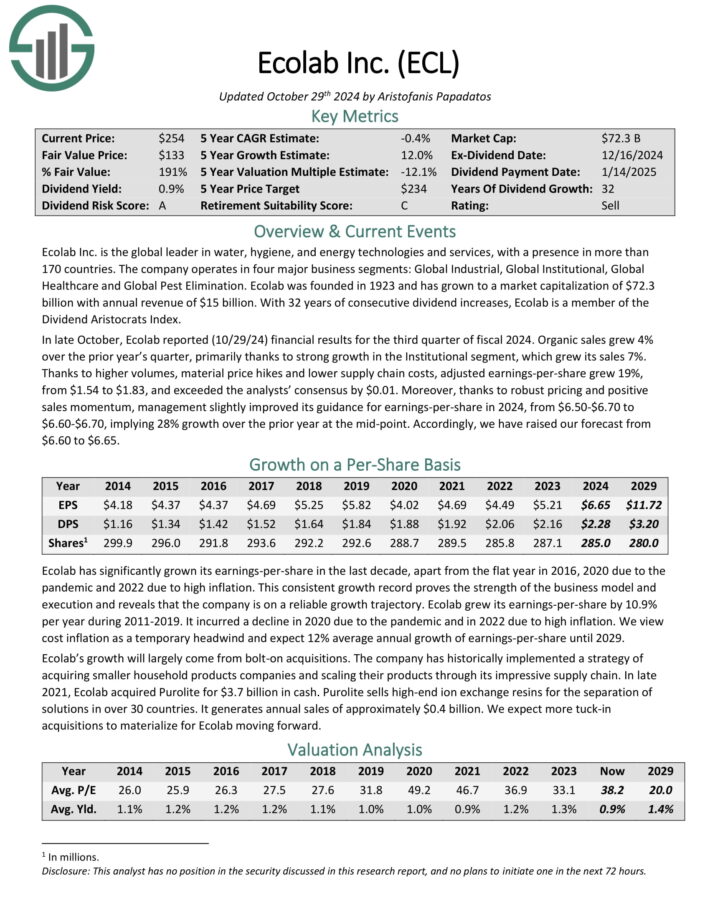

Ecolab Inc. is the worldwide chief in water, hygiene, and power applied sciences and providers, with a presence in additional than 170 nations.

The corporate operates in 4 main enterprise segments: International Industrial, International Institutional, International Healthcare and International Pest Elimination.

In late October, Ecolab reported (10/29/24) monetary outcomes for the third quarter of fiscal 2024. Natural gross sales grew 4% over the prior yr’s quarter, primarily due to sturdy development within the Institutional section, which grew its gross sales 7%.

Because of greater volumes, materials value hikes and decrease provide chain prices, adjusted earnings-per-share grew 19%, from $1.54 to $1.83, and exceeded the analysts’ consensus by $0.01.

Furthermore, due to sturdy pricing and optimistic gross sales momentum, administration barely improved its steering for earnings-per-share in 2024, from $6.50-$6.70 to $6.60-$6.70, implying 28% development over the prior yr on the mid-point.

Click on right here to obtain our most up-to-date Positive Evaluation report on ECL (preview of web page 1 of three proven beneath):

Finest Inventory Utilizing the Dividend Development Sign: S&P International (SPGI)

S&P International is a worldwide supplier of monetary providers and enterprise data and income of over $13 billion. By way of its numerous segments, it supplies credit score rankings, benchmarks and indices, analytics, and different information to commodity market individuals, capital markets, and automotive markets.

S&P International has paid dividends constantly since 1937 and has elevated its payout for 51 consecutive years.

S&P International posted third quarter earnings on October twenty fourth, 2024, and outcomes had been fairly sturdy as soon as once more. Adjusted earnings-per-share got here to $3.89, which was 25 cents forward of estimates. Earnings had been down from $4.04 in Q2, however a lot greater than $3.21 within the year-ago interval.

Income soared 16% greater year-on-year to $3.58 billion, which additionally beat estimates by $150 million. Development within the Scores and Indices section led the highest line greater in Q3, though power was broad.

Click on right here to obtain our most up-to-date Positive Evaluation report on SPGI (preview of web page 1 of three proven beneath):

Further Studying

The Dividend Aristocrats are among the many greatest dividend development shares to purchase and maintain for the long term. However the Dividend Aristocrats record will not be the one option to rapidly display screen for shares that often pay rising dividends.

We’ve got compiled a studying record for added dividend development inventory investing concepts:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to assist@suredividend.com.