Revealed on November twenty fifth, 2024 by Bob CiuraSpreadsheet knowledge up to date every day

We advocate long-term traders concentrate on high-quality dividend shares. To that finish, we view the Dividend Aristocrats as among the many finest dividend shares to buy-and-hold for the long term.

The Dividend Aristocrats have an extended historical past of outperforming the market on the subject of risk-adjusted returns.

There are at the moment 66 Dividend Aristocrats. You possibly can obtain an Excel spreadsheet of all 66 Dividend Aristocrats (with metrics that matter akin to dividend yields and price-to-earnings ratios) by clicking the hyperlink beneath:

Disclaimer: Positive Dividend shouldn’t be affiliated with S&P International in any manner. S&P International owns and maintains The Dividend Aristocrats Index. The knowledge on this article and downloadable spreadsheet is predicated on Positive Dividend’s personal assessment, abstract, and evaluation of the S&P 500 Dividend Aristocrats ETF (NOBL) and different sources, and is supposed to assist particular person traders higher perceive this ETF and the index upon which it’s primarily based. Not one of the info on this article or spreadsheet is official knowledge from S&P International. Seek the advice of S&P International for official info.

This text begins with an summary of the Dividend Aristocrats record. Then, we record our prime 10 Dividend Aristocrats you’ve by no means heard of.

The record is comprised of 10 Dividend Aristocrats, all of which have market caps beneath $25 billion, making them among the many smallest Dividend Aristocrats.

As well as, these 10 Dividend Aristocrats are likely to get a lot much less protection within the monetary media, and have a lot smaller followings than the biggest Dividend Aristocrats.

Desk of Contents

Dividend Aristocrats Overview

The necessities to be a Dividend Aristocrat are:

Be within the S&P 500

Have 25+ consecutive years of dividend will increase

Meet sure minimal measurement & liquidity necessities

All Dividend Aristocrats are high-quality companies primarily based on their lengthy dividend histories. An organization can’t pay rising dividends for 25+ years with out having a robust and sturdy aggressive benefit.

However not all Dividend Aristocrats make equally good investments as we speak. That’s the place the spreadsheet on this article comes into play. You should utilize the Dividend Aristocrats spreadsheet to rapidly discover high quality dividend funding concepts.

The record of all 66 Dividend Aristocrats is effective as a result of it offers you a concise record of all S&P 500 shares with 25+ consecutive years of dividend will increase (that additionally meet sure minimal measurement and liquidity necessities).

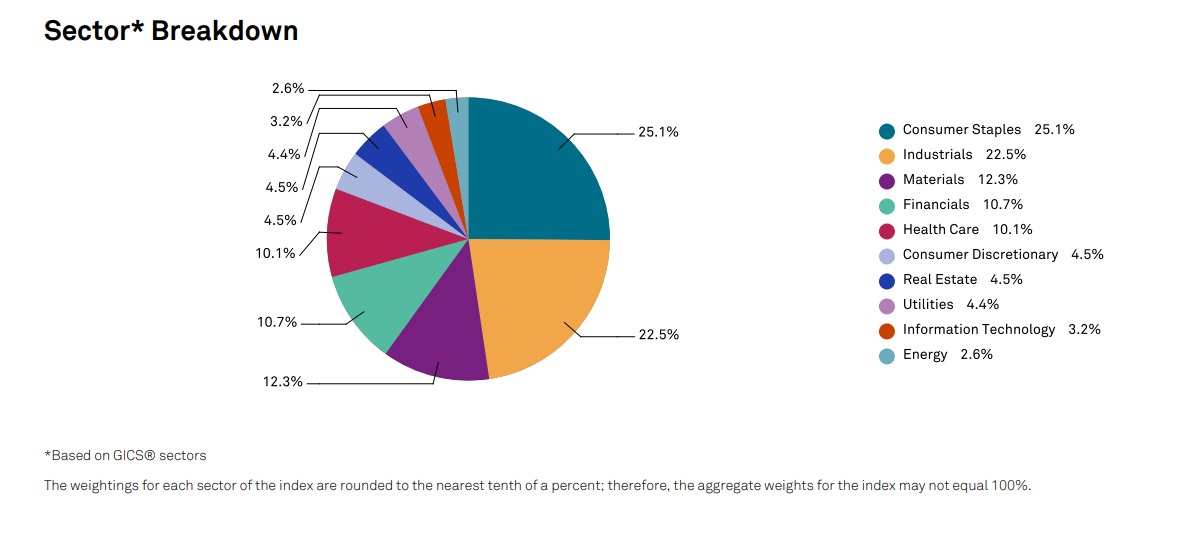

A sector breakdown of the Dividend Aristocrats Index is proven beneath:

The highest 2 sectors by weight within the Dividend Aristocrats are Industrials and Client Staples. The Dividend Aristocrats Index is tilted towards Client Staples and Industrials relative to the S&P 500.

These 2 sectors make up over 40% of the Dividend Aristocrats Index, however lower than 20% of the S&P 500.

The Dividend Aristocrats Index can be considerably underweight the Info Know-how sector, with a ~3% allocation in contrast with over 20% allocation inside the S&P 500.

The Dividend Aristocrat Index is stuffed with steady trade giants with market caps above $200 billion, akin to Coca-Cola (KO), ExxonMobil (XOM), and Johnson & Johnson (JNJ).

Nonetheless, there are smaller Dividend Aristocrats which can be price being attentive to. The next 10 Dividend Aristocrats have robust enterprise fashions, sturdy aggressive benefits, and long-term dividend development potential.

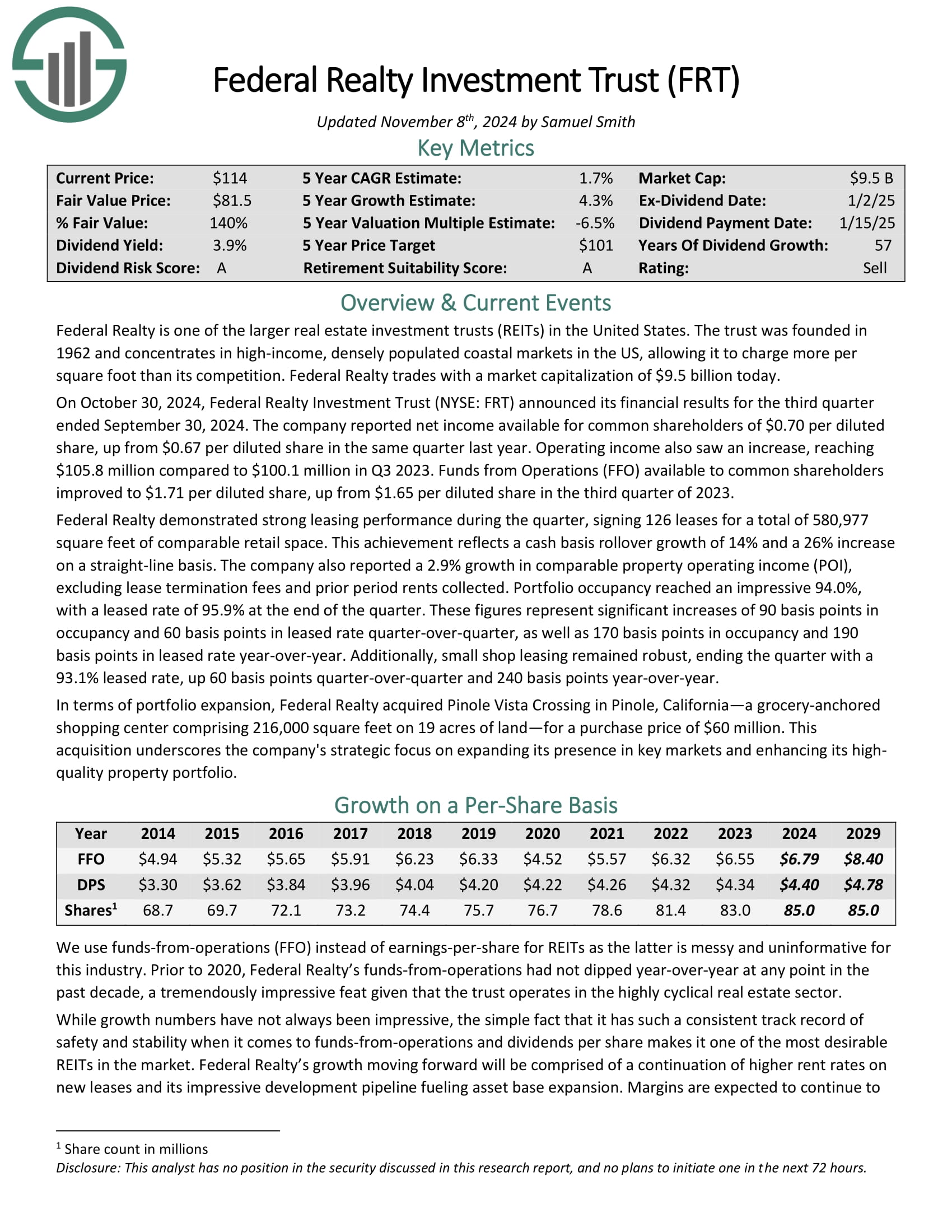

Dividend Aristocrat You’ve By no means Heard Of: Federal Realty Funding Belief (FRT)

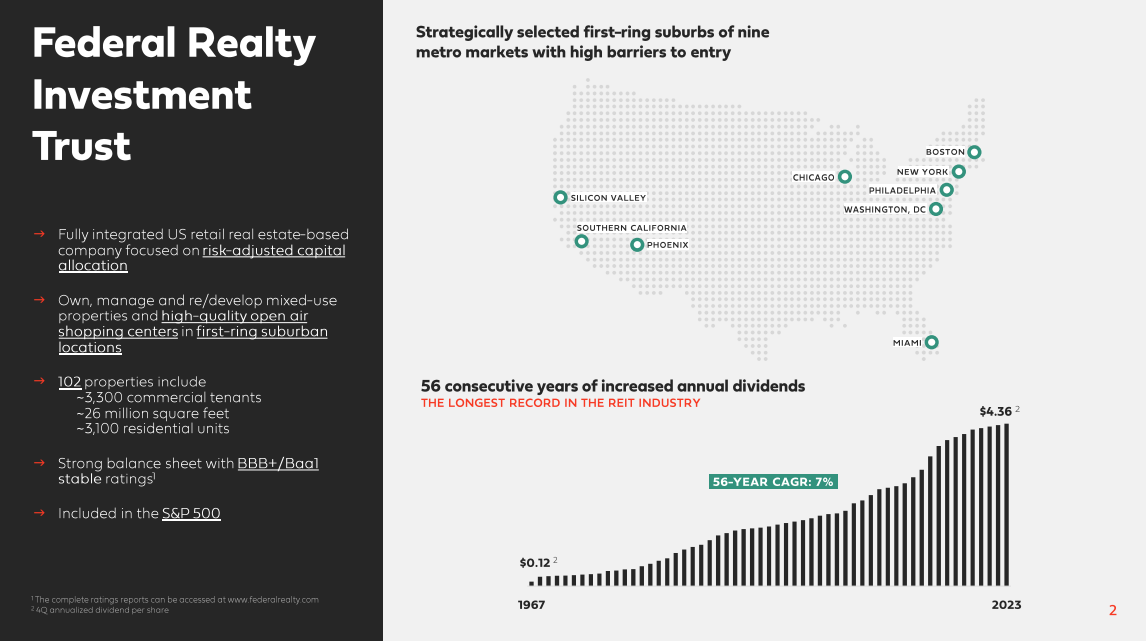

Federal Realty was based in 1962. As a Actual Property Funding Belief, Federal Realty’s enterprise mannequin is to personal and lease out actual property properties.

It makes use of a good portion of its rental earnings, in addition to exterior financing, to amass new properties.

Supply: Investor Presentation

On October 30, 2024, Federal Realty Funding Belief introduced its monetary outcomes for the third quarter ended September 30, 2024.

The corporate reported internet earnings out there for frequent shareholders of $0.70 per diluted share, up from $0.67 per diluted share in the identical quarter final 12 months. Working earnings additionally noticed a rise, reaching $105.8 million in comparison with $100.1 million in Q3 2023.

Funds from Operations (FFO) out there to frequent shareholders improved to $1.71 per diluted share, up from $1.65 per diluted share within the third quarter of 2023.

Click on right here to obtain our most up-to-date Positive Evaluation report on Federal Realty (preview of web page 1 of three proven beneath):

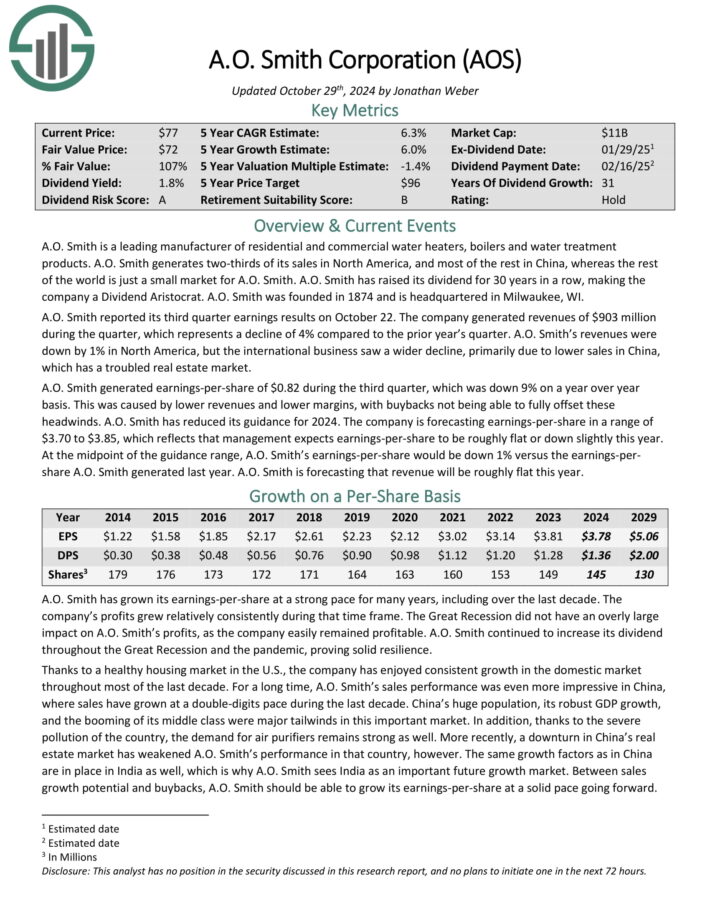

Dividend Aristocrat You’ve By no means Heard Of: A.O. Smith (AOS)

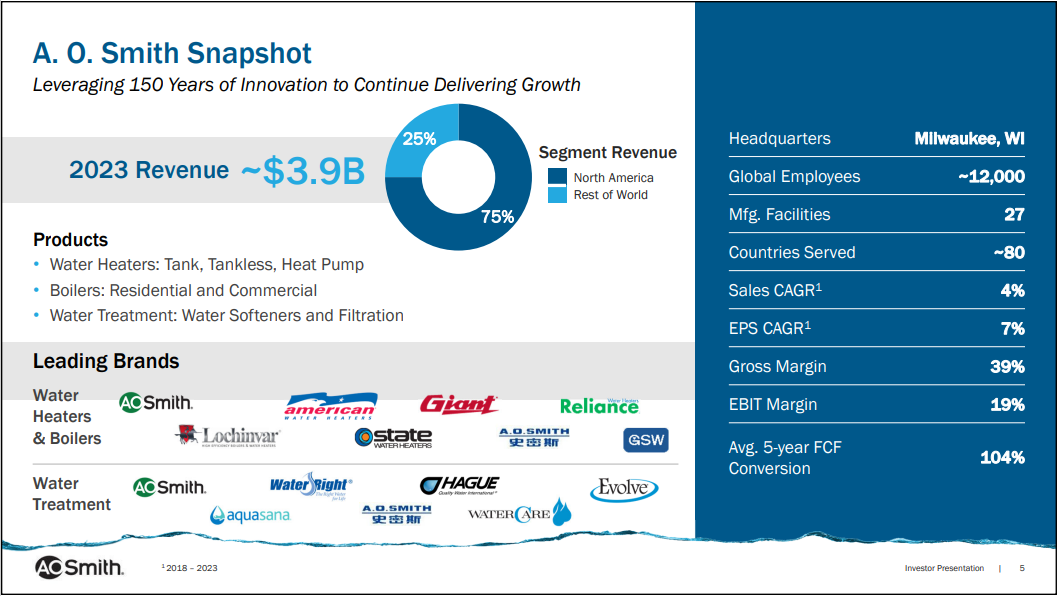

A.O. Smith is a number one producer of residential and industrial water heaters, boilers and water therapy merchandise.

A.O. Smith generates two-thirds of its gross sales in North America, and many of the relaxation in China, whereas the remainder of the world is only a small marketplace for A.O. Smith.

The corporate has raised its dividend for 30 years in a row.

Supply: Investor Presentation

A.O. Smith reported its third quarter earnings outcomes on October 22. The corporate generated revenues of $903 million in the course of the quarter, which represents a decline of 4% in comparison with the prior 12 months’s quarter.

Revenues had been down by 1% in North America, however the worldwide enterprise noticed a wider decline, primarily as a consequence of decrease gross sales in China, which has a troubled actual property market.

The corporate generated earnings-per-share of $0.82 in the course of the third quarter, which was down 9% on a 12 months over 12 months foundation.

Click on right here to obtain our most up-to-date Positive Evaluation report on AOS (preview of web page 1 of three proven beneath):

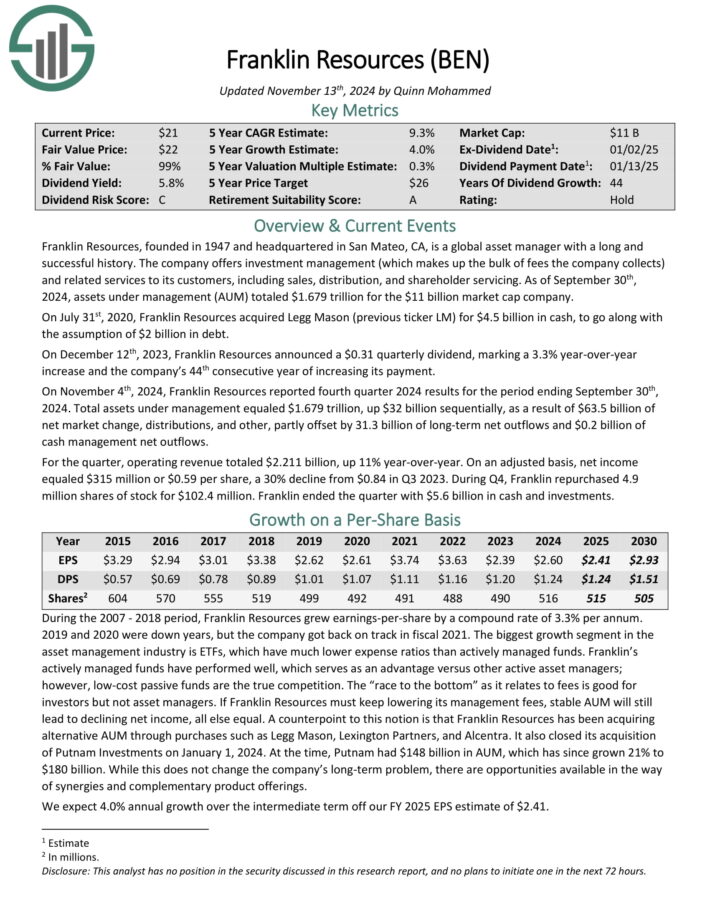

Dividend Aristocrat You’ve By no means Heard Of: Franklin Assets (BEN)

Franklin Assets is a worldwide asset supervisor with an extended and profitable historical past. The corporate affords funding administration (which makes up the majority of charges the corporate collects) and associated companies to its clients, together with gross sales, distribution, and shareholder servicing.

On November 4th, 2024, Franklin Assets reported fourth quarter 2024 outcomes for the interval ending September thirtieth, 2024.

Whole belongings underneath administration equaled $1.679 trillion, up $32 billion sequentially, on account of $63.5 billion of internet market change, distributions, and different, partly offset by 31.3 billion of long-term internet outflows and $0.2 billion of money administration internet outflows.

For the quarter, working income totaled $2.211 billion, up 11% year-over-year. On an adjusted foundation, internet earnings equaled $315 million or $0.59 per share.

Click on right here to obtain our most up-to-date Positive Evaluation report on Franklin Assets (preview of web page 1 of three proven beneath):

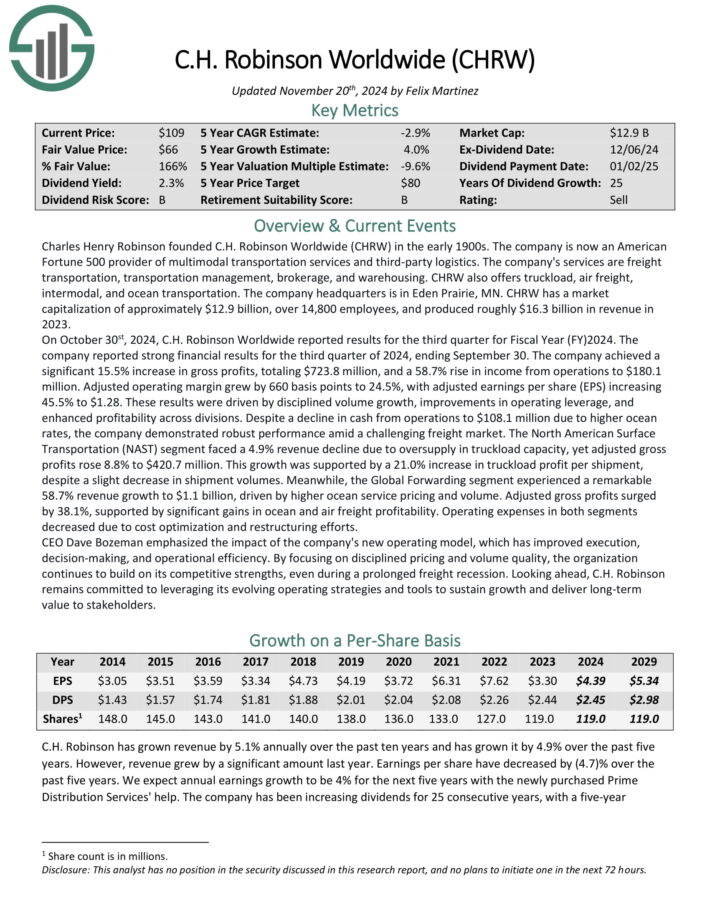

Dividend Aristocrat You’ve By no means Heard Of: C.H. Robinson Worldwide (CHRW)

Charles Henry Robinson based C.H. Robinson Worldwide within the early 1900s. The corporate is now an American Fortune 500 supplier of multimodal transportation companies and third-party logistics.

The corporate’s companies are freight transportation, transportation administration, brokerage, and warehousing. CHRW additionally affords truckload, air freight, intermodal, and ocean transportation.

On October 30st, 2024, C.H. Robinson Worldwide reported outcomes for the third quarter for Fiscal Yr (FY)2024. The corporate reported robust monetary outcomes for the third quarter of 2024, ending September 30.

The corporate achieved a major 15.5% enhance in gross earnings, totaling $723.8 million, and a 58.7% rise in earnings from operations to $180.1 million.

Adjusted working margin grew by 660 foundation factors to 24.5%, with adjusted earnings per share growing 45.5% to $1.28. These outcomes had been pushed by disciplined quantity development, enhancements in working leverage, and enhanced profitability throughout divisions.

Click on right here to obtain our most up-to-date Positive Evaluation report on CHRW (preview of web page 1 of three proven beneath):

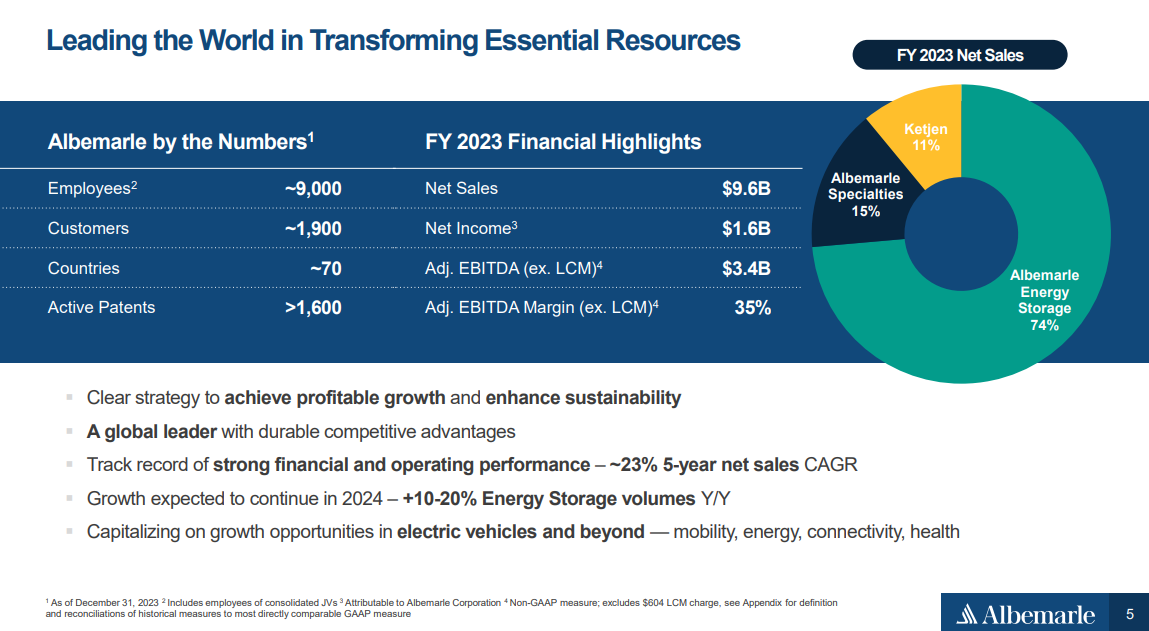

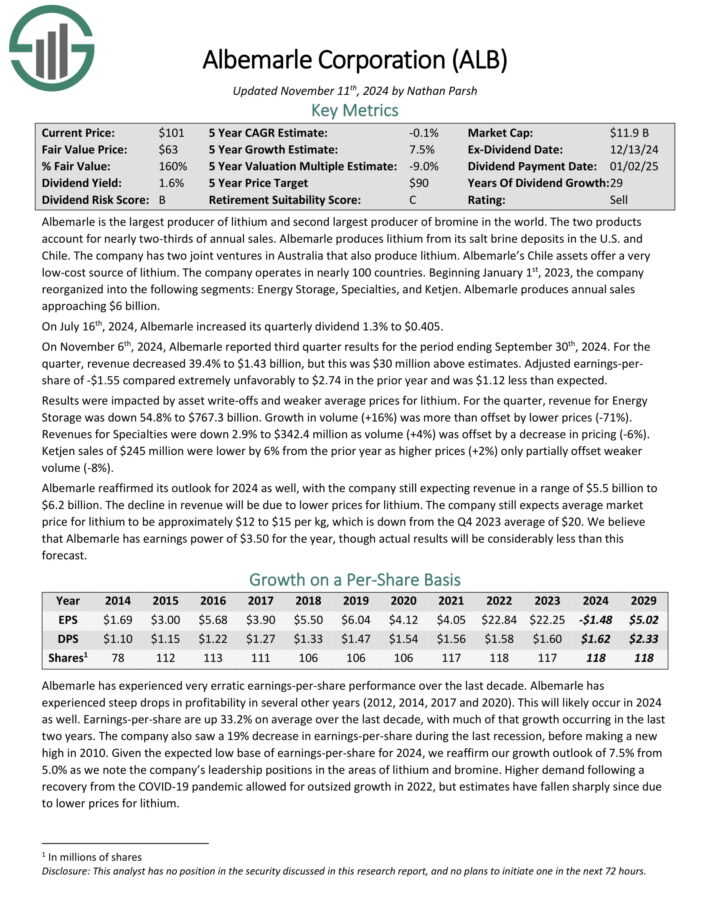

Dividend Aristocrat You’ve By no means Heard Of: Albemarle (ALB)

Albemarle is the biggest producer of lithium and second largest producer of bromine on the planet. The 2 merchandise account for practically two-thirds of annual gross sales. Albemarle produces lithium from its salt brine deposits within the U.S. and Chile.

The corporate has two joint ventures in Australia that additionally produce lithium. Albemarle’s Chile belongings provide a really low-cost supply of lithium. The corporate operates in practically 100 nations.

Supply: Investor Presentation

On November sixth, 2024, Albemarle reported third quarter outcomes for the interval ending September thirtieth, 2024. For the quarter, income decreased 39.4% to $1.43 billion, however this was $30 million above estimates. Adjusted earnings-per share of -$1.55 in contrast extraordinarily unfavorably to $2.74 within the prior 12 months and was $1.12 lower than anticipated.

Outcomes had been impacted by asset write-offs and weaker common costs for lithium. For the quarter, income for Power Storage was down 54.8% to $767.3 billion. Progress in quantity (+16%) was greater than offset by decrease costs (-71%).

Revenues for Specialties had been down 2.9% to $342.4 million as quantity (+4%) was offset by a lower in pricing (-6%). Ketjen gross sales of $245 million had been decrease by 6% from the prior 12 months as greater costs (+2%) solely partially offset weaker quantity (-8%).

Click on right here to obtain our most up-to-date Positive Evaluation report on ALB (preview of web page 1 of three proven beneath):

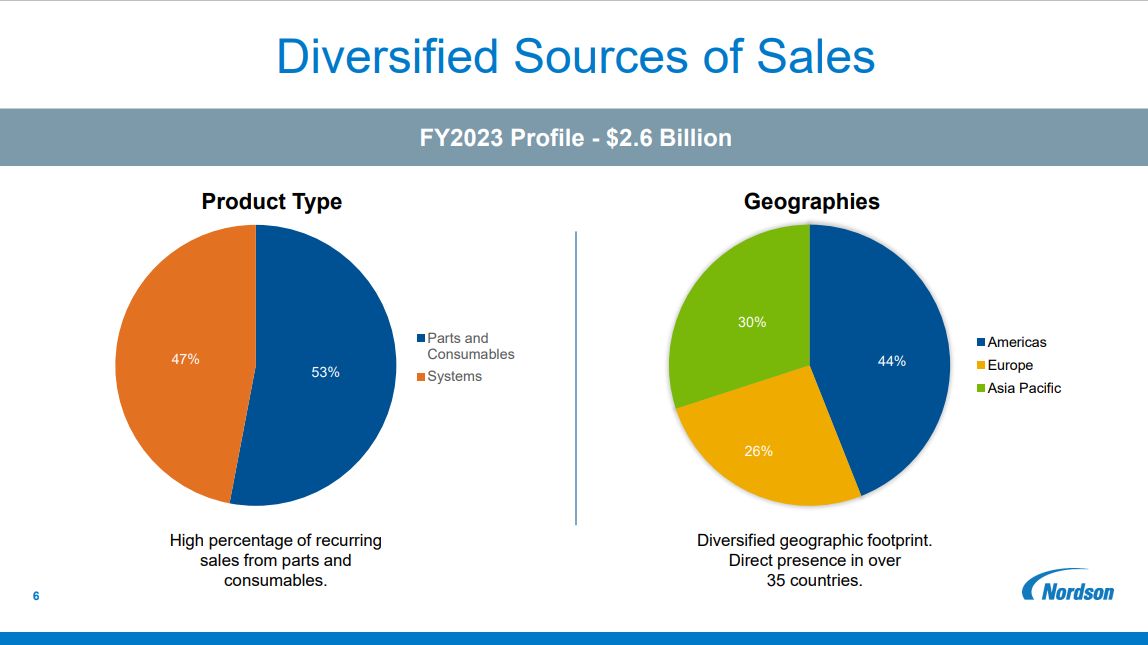

Dividend Aristocrat You’ve By no means Heard Of: Nordson Company (NDSN)

Nordson was based in 1954 in Amherst, Ohio by brothers Eric and Evan Nord, however the firm can hint its roots again to 1909 with the U.S. Computerized Firm.

At this time the corporate has operations in over 35 nations and engineers, manufactures, and markets merchandise used for shelling out adhesives, coatings, sealants, biomaterials, plastics, and different supplies, with purposes starting from diapers and straws to cell telephones and aerospace.

Supply: Investor Presentation

On August 14th, 2024, Nordson elevated its dividend by 15% to $0.78 per share quarterly, marking 61 years of will increase.

On August twenty first, 2024, Nordson reported third quarter outcomes for the interval ending July thirty first, 2024. (Nordson’s fiscal 12 months ends October thirty first.) For the quarter, the corporate reported gross sales of $662 million, 2% greater in comparison with $649 million in Q3 2023, which was pushed by a optimistic acquisition influence, and offset by natural lower of 1%.

The Industrial Precision noticed gross sales enhance by 9.6%, whereas the Medical and Fluid Options and Superior Know-how Options phase had gross sales declines of (2.4%) and (10.9%), respectively.

The corporate generated adjusted earnings per share of $2.41, a 6% lower in comparison with the identical prior 12 months interval.

Click on right here to obtain our most up-to-date Positive Evaluation report on NDSN (preview of web page 1 of three proven beneath):

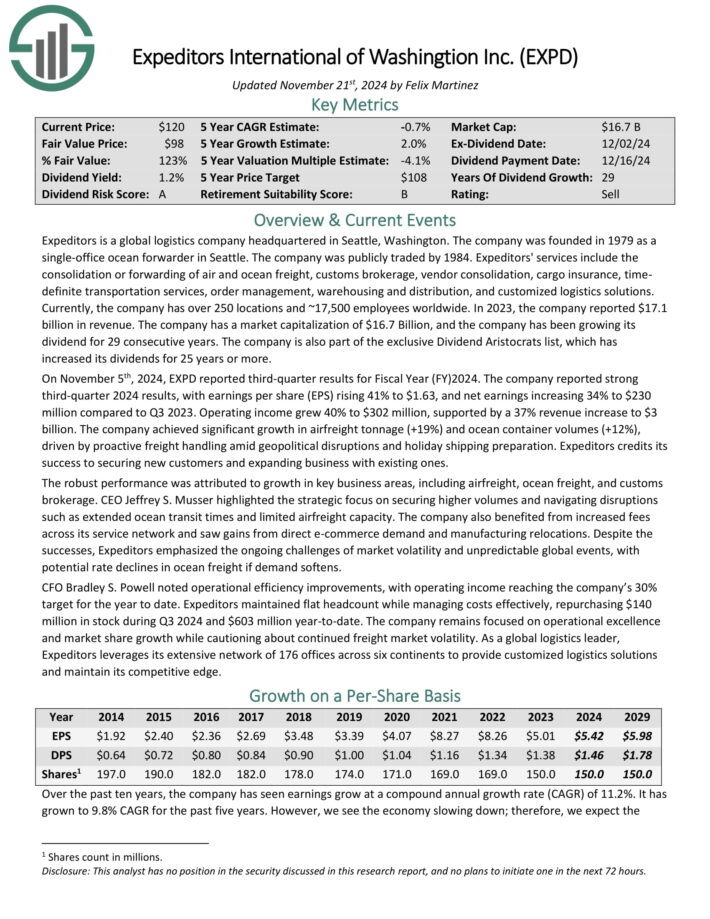

Dividend Aristocrat You’ve By no means Heard Of: Expeditors Worldwide of Washington (EXPD)

Expeditors is a worldwide logistics firm headquartered in Seattle, Washington. The corporate was based in 1979 as a single-office ocean forwarder in Seattle.

Its companies embrace the consolidation or forwarding of air and ocean freight, customs brokerage, vendor consolidation, cargo insurance coverage, time particular transportation companies, order administration, warehousing and distribution, and customised logistics options.

At the moment, the corporate has over 250 areas and ~17,500 staff worldwide. In 2023, the corporate reported $17.1 billion in income. The corporate has elevated its dividend for 29 consecutive years.

On November fifth, 2024, EXPD reported third-quarter outcomes for Fiscal Yr (FY)2024. The corporate reported robust third-quarter 2024 outcomes, with earnings per share (EPS) rising 41% to $1.63, and internet earnings growing 34% to $230 million in comparison with Q3 2023.

Working earnings grew 40% to $302 million, supported by a 37% income enhance to $3 billion. The corporate achieved important development in airfreight tonnage (+19%) and ocean container volumes (+12%), pushed by proactive freight dealing with amid geopolitical disruptions and vacation transport preparation.

Click on right here to obtain our most up-to-date Positive Evaluation report on EXPD (preview of web page 1 of three proven beneath):

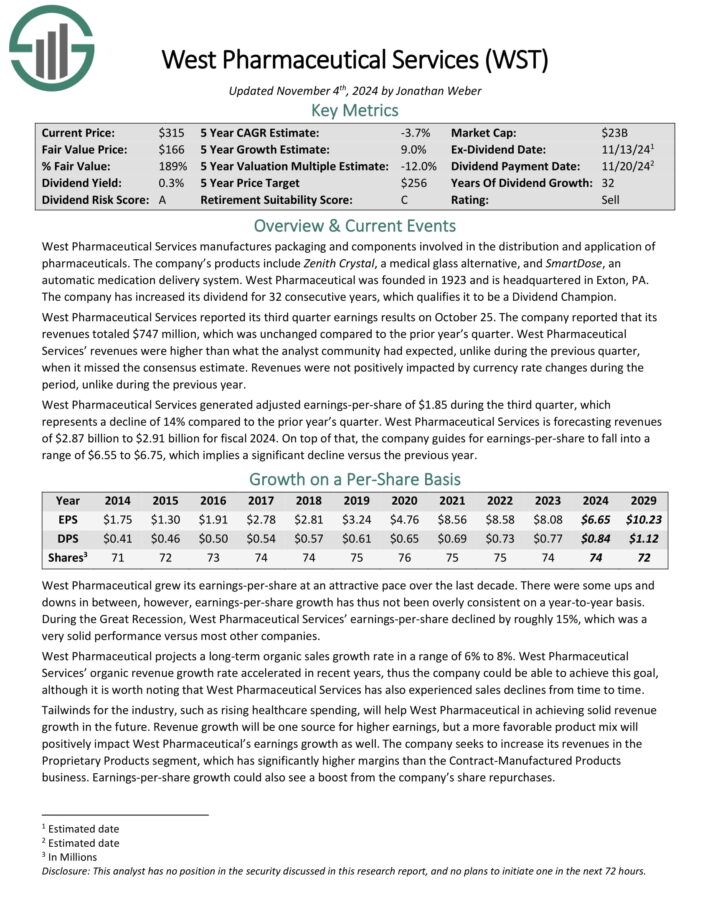

Dividend Aristocrat You’ve By no means Heard Of: West Pharmaceutical Companies (WST)

West Pharmaceutical Companies manufactures packaging and elements concerned within the distribution and software of prescribed drugs. The corporate’s merchandise embrace Zenith Crystal, a medical glass different, and SmartDose, an automated remedy supply system.

West Pharmaceutical Companies reported its second quarter earnings outcomes on July 25. The corporate reported that its revenues totaled $702 million, which represents a income decline of seven% in comparison with the prior 12 months’s quarter.

West Pharmaceutical Companies’ revenues had been decrease than what the analyst group had anticipated, in contrast to in the course of the earlier quarter, when it beat the consensus estimate. Revenues weren’t positively impacted by foreign money fee adjustments in the course of the interval, in contrast to in the course of the earlier 12 months.

West Pharmaceutical Companies generated adjusted earnings-per-share of $1.52 in the course of the second quarter, which represents a decline of 28% in comparison with the prior 12 months’s quarter.

Click on right here to obtain our most up-to-date Positive Evaluation report on WST (preview of web page 1 of three proven beneath):

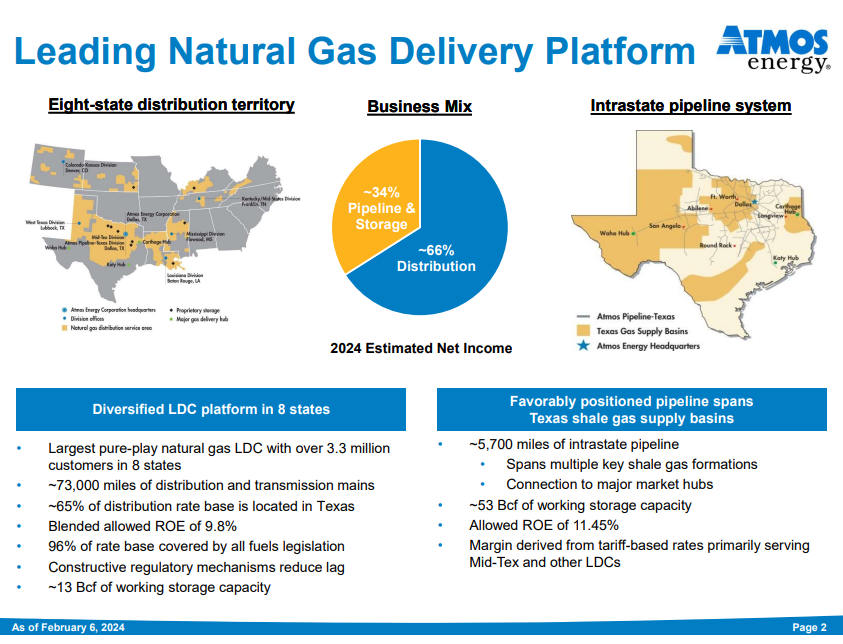

Dividend Aristocrat You’ve By no means Heard Of: Atmos Power (ATO)

Atmos Power can hint its beginnings all the way in which again to 1906 when it was shaped in Texas. Since that point, it has grown each organically and thru mergers.

The corporate distributes and shops pure fuel in eight states, serves over 3 million clients, and may generate about $5 billion in income this 12 months.

Supply: Investor Presentation

Atmos has a 41-year historical past of elevating dividends, placing it in uncommon firm amongst dividend shares.

Atmos posted fourth quarter and full-year earnings on November sixth, 2024, and outcomes had been largely in step with expectations. The corporate noticed simply over a billion {dollars} in internet earnings for the 12 months, and $134 million for the fourth quarter. On a per-share foundation, earnings got here to $6.83 and 86 cents, respectively.

For the quarter, distribution earnings got here to $41 million, which was up from $38 million a 12 months in the past. Pipeline and storage earnings had been $93 million, up from $81 million in final 12 months’s This autumn.

For the 12 months, distribution earnings rose from $580 million to $671 million. Pipeline and storage full-year earnings had been up sharply from $306 million to $372 million, serving to to drive one other 12 months of report earnings for Atmos.

Click on right here to obtain our most up-to-date Positive Evaluation report on ATO (preview of web page 1 of three proven beneath):

Dividend Aristocrat You’ve By no means Heard Of: Cincinnati Monetary (CINF)

Cincinnati Monetary is an insurance coverage firm based in 1950. It affords enterprise, house, auto insurance coverage, and monetary merchandise, together with life insurance coverage, annuities, property, and casualty insurance coverage.

As an insurance coverage firm, Cincinnati Monetary makes cash in two methods. It earns earnings from premiums on insurance policies written and by investing its float, or the big sum of cash consisting of the time worth between the premium earnings and insurance coverage claims.

On October twenty fourth, 2024, Cincinnati Monetary reported the third quarter outcomes for Fiscal Yr (FY)2024. The corporate reported sturdy third-quarter 2024 monetary outcomes, highlighted by a internet earnings of $820 million, or $5.20 per share, in comparison with a internet lack of $99 million in the identical interval final 12 months.

This enchancment was pushed by a $645 million enhance within the honest worth of fairness securities and a $956 million rise in internet funding positive aspects.

The corporate’s e book worth per share rose 15% year-to-date to $88.32, and the worth creation ratio reached 17.8%, considerably above the 4.4% recorded for a similar interval in 2023.

Click on right here to obtain our most up-to-date Positive Evaluation report on CINF (preview of web page 1 of three proven beneath):

Extra Studying

The Dividend Aristocrats are among the many finest dividend development shares to purchase and maintain for the long term. However the Dividend Aristocrats record shouldn’t be the one approach to rapidly display screen for shares that repeatedly pay rising dividends.

We have now compiled a studying record for added dividend development inventory investing concepts:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to assist@suredividend.com.