• Fed price minimize, FOMC dot-plot, Powell feedback shall be in focus this week.

• Micron presents vital upside potential backed by sturdy earnings progress and robust demand for its AI-related merchandise.

• Nike faces mounting challenges, with declining revenues, a cautious outlook, and comfortable client demand suggesting additional draw back for its inventory worth.

• On the lookout for extra actionable commerce concepts? Subscribe right here for 55% off InvestingPro as a part of our Cyber Week Prolonged sale!

U.S. shares closed principally decrease on Friday, with the posting its longest run of losses since 2020, as traders priced in the potential of the Federal Reserve reducing charges extra slowly subsequent yr.

For the week, the blue-chip Dow fell 1.8%, the dipped about 0.6%, whereas the tech-heavy tacked on round 0.3% to safe its fourth consecutive week of positive factors.

Supply: Investing.com

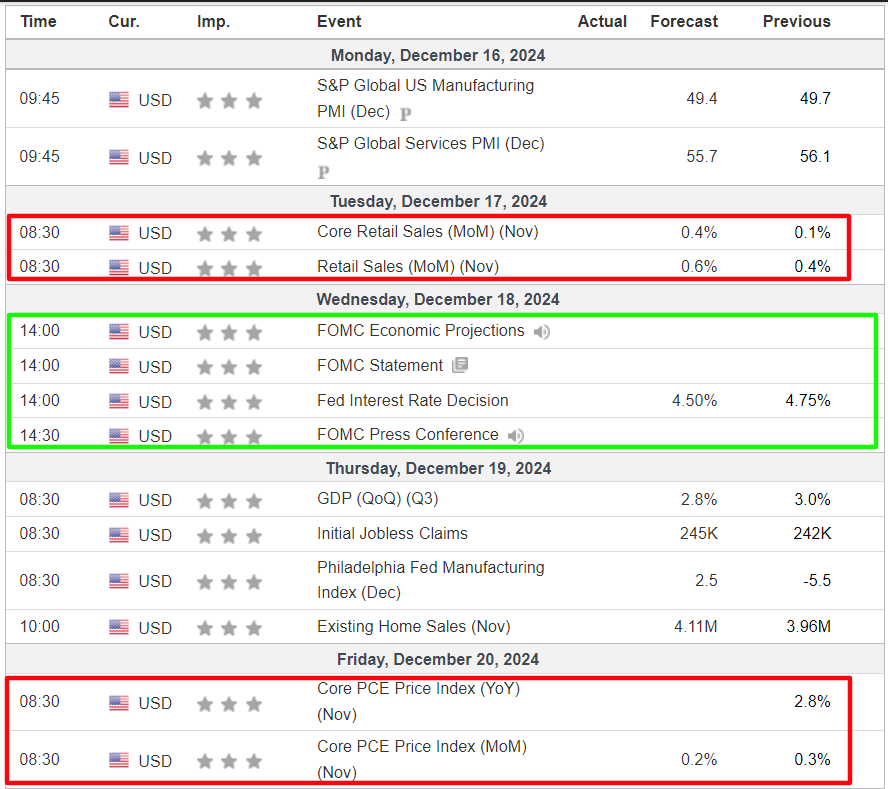

The blockbuster week forward is predicted to be a busy one full of a number of market-moving occasions, together with the Fed’s last financial coverage assembly of 2024. An official assertion is due at 2:00PM ET on Wednesday. Fed chair Jerome Powell will communicate at 2:30PM ET.

With a 25-basis level price minimize assured, traders will deal with the central financial institution’s steering on rates of interest amid indications Powell may sign a pause in coverage easing.

In the meantime, on the financial calendar, most essential shall be Tuesday’s U.S. retail gross sales report, which is able to shed additional gentle on the well being of the financial system. The non-public consumption expenditures worth index studying for November, due Friday, will even be carefully watched.

Supply: Investing.com

Elsewhere, on the earnings docket, there are only a handful of company outcomes due, together with Nike (NYSE:), FedEx (NYSE:), Micron Expertise (NASDAQ:), Lennar (NYSE:), Common Mills (NYSE:), and Carnival (NYSE:) as Wall Avenue’s reporting season attracts to an in depth.

No matter which route the market goes, beneath I spotlight one inventory more likely to be in demand and one other which may see contemporary draw back. Keep in mind although, my timeframe is only for the week forward, Monday, December 16 – Friday, December 20.

Inventory to Purchase: Micron

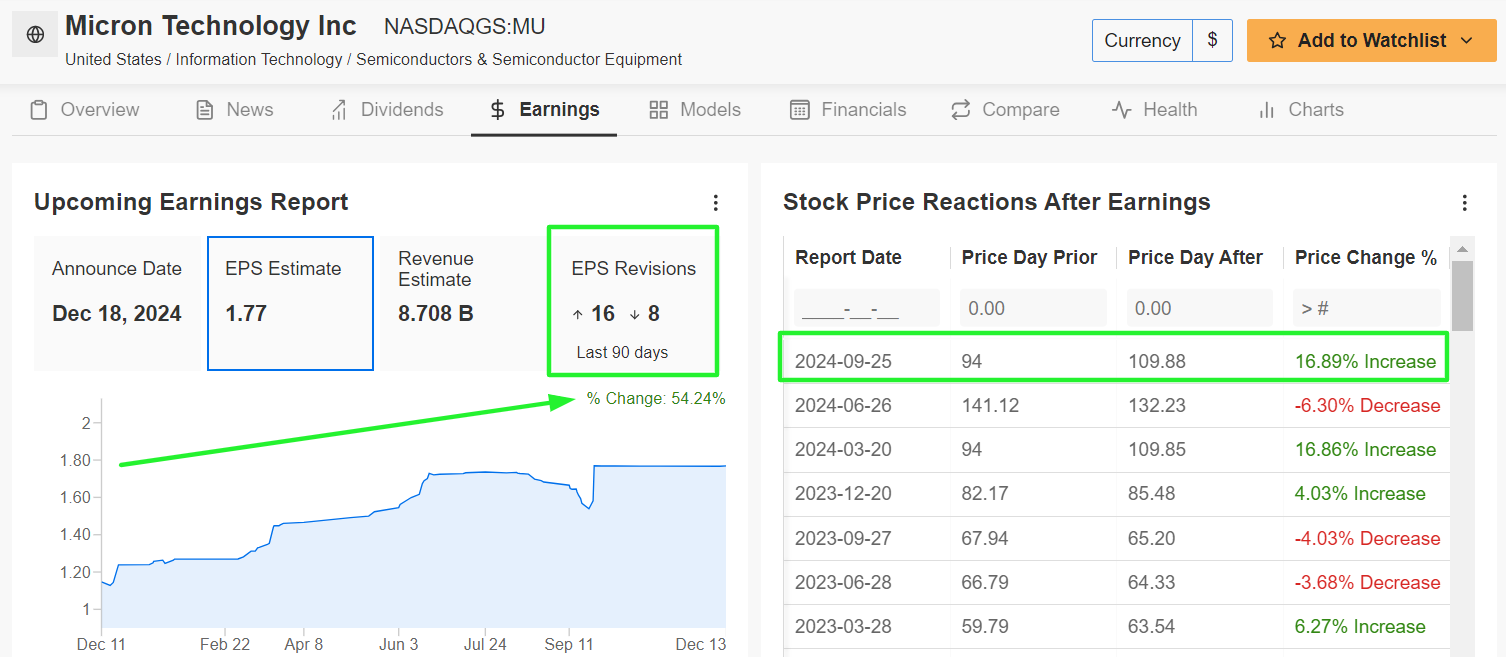

Micron is poised for a strong week because the reminiscence chip maker gears as much as report its fiscal first-quarter outcomes on Wednesday at 4:05PM ET. A name with president and chief govt officer Sanjay Mehrotra is about for five:00PM ET.

Market members count on a large swing in MU inventory after the replace drops, in line with the choices market, with a doable implied transfer of +/-11.7% in both route. Earnings have been catalysts for outsized swings in shares this yr, with MU surging almost 17% when the corporate final reported quarterly numbers in September.

Wall Avenue anticipates robust earnings pushed by sturdy demand for its Excessive-Bandwidth Reminiscence (HBM3E) chips, that are important for AI and cloud computing functions.

Including to the bullish sentiment, 16 of the 24 analysts surveyed by InvestingPro have revised their earnings estimates upward over the previous three months.

Supply: InvestingPro

Micron is seen incomes $1.77 a share, reversing a pointy year-ago lack of $0.95 per share, signaling a big restoration after a difficult interval within the reminiscence market. Income is forecast to soar 83.9% yearly to $8.70 billion, benefiting from gross sales of high-bandwidth reminiscence gadgets to knowledge facilities working AI functions.

The Boise, Idaho-based firm performs a important function in powering developments in AI, cloud computing, and 5G connectivity with its modern DRAM and NAND merchandise.

Wanting forward, I imagine Micron’s administration will present strong steering for the present quarter to mirror sturdy reminiscence demand from cloud suppliers as progress prospects in synthetic intelligence stay robust. Micron’s groundbreaking HBM3E expertise, a key enabler for AI workloads, is predicted to be a cornerstone of its progress technique.

MU inventory ended Friday’s session at $102.50. At present ranges, Micron has a market valuation of $113.7 billion. Shares, which reached an all-time excessive of $157.54 on June 18, are up 20.1% within the year-to-date.

Supply: Investing.com

It must be famous that Micron inventory stays undervalued in line with the InvestingPro Truthful Worth mannequin and will see a rise of 8.5% to $111.22.

You’ll want to take a look at InvestingPro to remain in sync with the market development and what it means in your buying and selling. Subscribe now and get 55% off and place your portfolio one step forward of everybody else!

Inventory to Promote: Nike

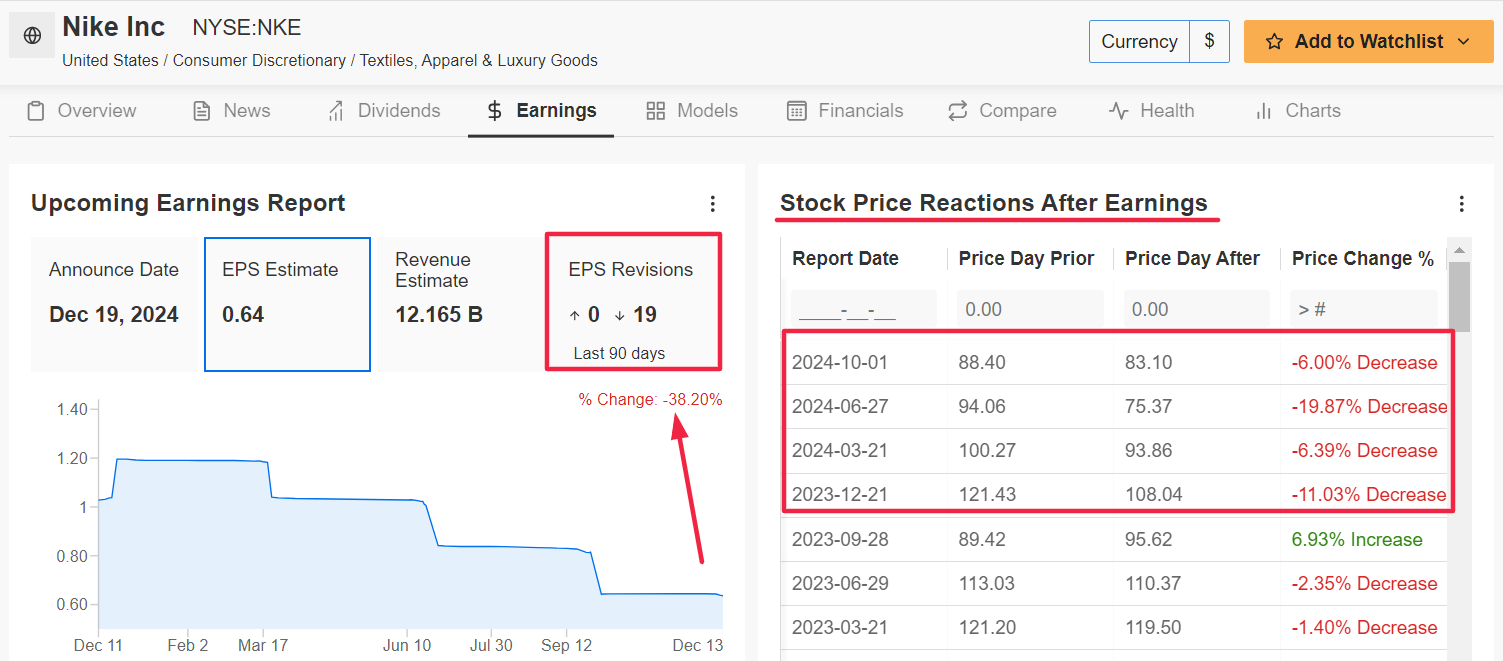

In distinction, Nike, the worldwide athletic attire big, faces vital headwinds this week because it prepares to report fiscal second-quarter outcomes on Thursday at 4:15PM ET.

Regardless of its robust model recognition, the corporate is grappling with declining client demand for athletic put on and footwear, alongside provide chain challenges.

In line with the choices market, merchants are pricing in a swing of +/-7.7% in both route for NKE inventory following the print. Notably, shares gapped down after earnings prior to now 4 quarters, and continued challenges counsel additional draw back.

Analysts have slashed their revenue estimates amid weakening working margins and slowing progress in North America and China, two of Nike’s largest markets.

Supply: InvestingPro

Nike is predicted to submit a 37.8% drop in adjusted earnings per share to $0.64, with income projected to say no by 9.7% from the year-ago interval to $12.1 billion.

The sneaker big has confronted mounting challenges in current quarters, battling weakening demand for athletic footwear and attire amid a softening macroeconomic surroundings.

The main target shall be on newly reappointed CEO Elliott Hill’s plans for a turnaround after the corporate pivoted to a direct-to-consumer mannequin, which has struggled to offset declining wholesale revenues.

NKE inventory – which fell to a 2024 low of $70.75 on August 5 – closed at $77.25 on Friday. At its present valuation, the Beaverton, Oregon-based sportswear retailer has a market cap of $115 billion. Shares are down 28.8% within the year-to-date.

Supply: Investing.com

It must be famous that Nike has a beneath common InvestingPro ‘Monetary Well being’ rating of two.4 out of 5.0 attributable to ongoing considerations over weakening gross revenue margins and spotty gross sales progress.

Whether or not you are a novice investor or a seasoned dealer, leveraging InvestingPro can unlock a world of funding alternatives whereas minimizing dangers amid the difficult market backdrop.

Subscribe now to get 55% off all Professional plans with our Cyber Week Prolonged supply and immediately unlock entry to a number of market-beating options, together with:

• ProPicks AI: AI-selected inventory winners with confirmed observe document.

• InvestingPro Truthful Worth: Immediately discover out if a inventory is underpriced or overvalued.

• Superior Inventory Screener: Seek for the very best shares based mostly on lots of of chosen filters, and standards.

• High Concepts: See what shares billionaire traders similar to Warren Buffett, Michael Burry, and George Soros are shopping for.

Disclosure: On the time of writing, I’m lengthy on the S&P 500, and the by way of the SPDR® S&P 500 ETF (SPY), and the Invesco QQQ Belief ETF (QQQ). I’m additionally lengthy on the Invesco High QQQ ETF (QBIG), Invesco S&P 500 Equal Weight ETF (RSP), and VanEck Vectors Semiconductor ETF (SMH).

I frequently rebalance my portfolio of particular person shares and ETFs based mostly on ongoing danger evaluation of each the macroeconomic surroundings and corporations’ financials.

The views mentioned on this article are solely the opinion of the writer and shouldn’t be taken as funding recommendation.

Observe Jesse Cohen on X/Twitter @JesseCohenInv for extra inventory market evaluation and perception.